Embracing Sustainability in Insurance: The IK Hub Course

May 05, 2025Written by Sabine VanderLinden

Lessons from Designing a Course with the Insurance Knowledge Hub.

Access the course HERE.

- ESG integration transforms insurance underwriting models: The IK Hub sustainability course equips insurance professionals to quantify climate risks, embed environmental factors into pricing algorithms, and develop parametric insurance products that address the $1.8 trillion protection gap while meeting regulatory demands for TCFD compliance and net-zero commitments.

- Sustainable insurance innovation through venture-client partnerships: Leading insurers leverage the DIVAAA framework to identify and adopt InsurTech solutions for ESG data analytics, carbon footprint tracking, and nature-positive underwriting, moving beyond pilot purgatory to scale sustainable insurance products that attract conscious consumers and institutional investors.

- Climate risk expertise drives insurance talent transformation: Insurance professionals completing sustainability training report 45% higher career advancement rates as carriers prioritize ESG-fluent leaders who can navigate transition risks, develop green insurance products, and bridge the gap between traditional actuarial models and climate science projections.

The Pivotal Crossroads

The insurance industry stands at a pivotal crossroads. As climate change accelerates, social expectations shift, and regulatory pressures mount, the sector faces a stark choice: adapt and lead on sustainability, or risk irrelevance and financial peril.

The risk of doing nothing is no longer theoretical—it is a tangible threat to the viability of insurers, their clients, and the communities they serve. Against this backdrop, the course co-developed by Insurance Knowledge Hub and our team at Alchemy Crew, "Embracing Sustainability in Insurance," emerges, I believe, as a timely, practical, and transformative resource for industry leaders.

I wrote this article with the goal of exploring what it truly takes to embrace sustainability in insurance, drawing on the course’s unique framework, real-world insights from experts implementing tech solutions, and the urgent imperative for action.

Make sure to join the movement and complete the course to get your certification and accreditations.

The Urgency of Sustainability in Insurance

The insurance sector is uniquely exposed to the consequences of environmental and societal risks. Catastrophic weather events, rising sea levels, and shifting disease patterns are no longer distant possibilities—they are realities that have already led to record-breaking insured losses worldwide.

In 2023 alone, global insured losses from natural catastrophes exceeded $120 billion, with climate change amplifying both the frequency and severity of such events. The World Economic Forum consistently ranks climate action failure and extreme weather among the top global risks, underscoring the existential threat to insurers’ business models and the communities they protect.

In recent years, there has been a dramatic escalation in the frequency and severity of climate-driven catastrophes. In 2024 alone, global insured losses from natural disasters reached $145 billion, marking the third most expensive year on record and continuing a five-year streak of losses exceeding $100 billion annually. (Sigma Report.)

The United States accounted for nearly 80% of these insured losses, with events like the Los Angeles wildfires and Hurricanes Helene and Milton each causing tens of billions in damages. The economic toll is even greater: total global losses from natural disasters in 2024 surpassed $320 billion, with only about 40% covered by insurance, leaving a protection gap of $181 billion. This gap is widening as more assets become uninsurable or underinsured, particularly in high-risk regions where insurers retreat or raise premiums to unaffordable levels.

These trends are not isolated to property insurance. Climate change is also driving up claims and costs in auto, health, and life insurance, as extreme heat, air pollution, and water scarcity contribute to higher mortality, morbidity, and infrastructure damage.

The industry’s financial stability is under threat, with many insurers paying out more in claims than they receive in premiums, leading to a wave of insolvencies and market withdrawals.

The Cost of Doing Nothing: Financial and Societal Risks

For insurers, the cost of ignoring sustainability is multifaceted and escalating. Financially, the industry is already grappling with the “protection gap”—the growing divide between economic losses from disasters and the portion covered by insurance. This gap, estimated at over $1.9 trillion globally, is widening as climate risks outpace traditional actuarial models.

Insurers who fail to integrate sustainability into their core operations risk being unable to price risk accurately, leading to unprofitable portfolios, capital shortfalls, and, in extreme cases, market exits.

The risk of inaction on sustainability is not theoretical—it is already manifesting in the destabilization of insurance markets, the erosion of consumer trust, and the undermining of economic resilience. If insurers fail to adapt, the consequences will be profound and far-reaching. As climate risks intensify, insurers are increasingly unable to price policies or maintain solvency in high-risk areas accurately. This has led to a growing number of insurers exiting markets, particularly in regions prone to wildfires, hurricanes, and floods.

The result is the emergence of "insurance deserts," where coverage is either unavailable or prohibitively expensive, threatening the viability of entire communities and local economies.

Without insurance, homeowners cannot secure mortgages, businesses cannot invest, and governments face mounting fiscal burdens from disaster recovery.

Societally, the consequences are even more profound. Insurance is a cornerstone of economic resilience, enabling individuals, businesses, and governments to recover from shocks. When insurers withdraw from high-risk markets or raise premiums beyond affordability, entire communities are left vulnerable, exacerbating inequality and undermining social stability.

The risk of doing nothing, therefore, is not just a business risk—it is a societal failure.

Regulatory and reputational risks are also mounting. Governments are responding to public outcry by imposing new regulations on insurers, including stricter disclosure requirements, limits on rate increases, and mandates to maintain coverage in high-risk areas.

At the same time, insurers face growing reputational risks from climate-related lawsuits, accusations of greenwashing, and public scrutiny of their investments in fossil fuels.

Failure to act on sustainability can result in regulatory penalties, loss of market share, and long-term damage to brand reputation.

The insurance industry is a cornerstone of financial stability, enabling investment, lending, and economic growth. If climate risks render large swathes of assets uninsurable, the ripple effects could destabilize the broader financial system, undermine municipal and corporate bond markets, and impede the transition to a low-carbon economy.

The Alchemy Crew Ventures and Insurance Knowledge Hub Course: A Blueprint for Your Transformation

Recognizing these challenges, our teams at Alchemy Crew Ventures and Insurance Knowledge Hub have developed a course that breaks through the noise and offers a practical, actionable framework for embracing sustainability in insurance.

This course is a transformation framework built on real-world innovation, operationalized environmental strategies, product design, and a deep understanding of the insurance value chain.

1- Unique Framework

At the heart of the course is a robust, flexible framework designed to help insurance professionals move from intention to action. The curriculum guides participants through unpacking what sustainability truly means for insurance, exploring its application across the value chain, and evaluating proven strategies and technologies that deliver both profitability and positive societal outcomes.

The framework is distinguished by several key features:

- Transformation-Driven Approach: The course positions sustainability not as a compliance exercise, but as a driver of business transformation and growth. It challenges executives to break from the status quo and lead with intention, embedding sustainability into the DNA of their organizations.

- Operationalization of ESG: Participants learn how to move beyond ESG reporting to operationalize sustainability in underwriting, claims, product development, and customer engagement. This includes leveraging data-driven insights to identify and mitigate emerging risks and embedding agility into business models to respond to evolving challenges.

- Real-World Innovation: Drawing on our corporate-startup venturing track record at Alchemy Crew, the course emphasizes practical, tested solutions rather than abstract theory. Case studies and examples illustrate how leading insurers are already delivering measurable impact through sustainability initiatives.

- Ecosystem Thinking: The framework encourages collaboration across the insurance ecosystem—insurers, reinsurers, brokers, startups, and policymakers—to drive systemic change and unlock new growth opportunities.

2- Learning Outcomes

The course is designed for forward-thinking executives and professionals who are ready to lead the sustainability transformation in insurance. By the end of the program, participants will:

- Understand the True Scope of Sustainability: Gain a nuanced understanding of sustainability as it applies to insurance, including environmental, social, and governance dimensions.

- Apply Sustainability Across the Value Chain: Learn how to integrate sustainability into every stage of the insurance process, from product design and underwriting to claims management and customer engagement.

- Evaluate and Implement Proven Strategies: Assess the effectiveness of different sustainability strategies and technologies, and develop the skills to implement them within their organizations.

- Operationalize Environmental-Led and Data-Driven Insights: Acquire practical tools for embedding environmental considerations into decision-making, leveraging data analytics to drive better outcomes for both business and society.

- Lead with Agility and Intent: Develop the mindset and capabilities needed to lead organizational change, foster innovation, and build resilient, future-ready insurance businesses.

3- Real-World Impact and Industry Recognition

The course’s impact, we hope, will amplify our companies' reputation as trailblazers in insurance innovation. At Alchemy Crew, we have accelerated over 160 ventures and screened more than 55,000 startups globally, and we bring unparalleled expertise in de-risking innovation and driving measurable outcomes. Insurance Knowledge Hub is building a reputation to connect the digital transformation dots in insurance.

The course has garnered industry recognition for its practical relevance and transformative potential, with testimonials highlighting its ability to equip leaders with the tools and confidence to drive sustainability initiatives.

Participants have praised the course for its actionable insights, real-world case studies, and the opportunity to engage with a network of like-minded professionals committed to shaping the future of insurance.

We now look forward to hearing industry bodies and conference organizers recognize the course’s unique framework and learning outcomes, further validating its value to the sector.

Innovations and Technologies Driving Sustainability in Insurance

The course strongly emphasizes the role of technology and innovation in advancing sustainability. Artificial intelligence, data analytics, and digital platforms are transforming key insurance processes, from underwriting and risk modeling to claims processing and customer service.

For example, AI-powered solutions enable insurers to assess climate risks with unprecedented accuracy, price products dynamically, and incentivize policyholders to adopt sustainable behaviors.

1- Sustainable Underwriting

Underwriting is the heart of insurance, and it is here that the sustainability revolution is most visible. Traditional actuarial models, reliant on historical data, are increasingly inadequate in the face of climate volatility and emerging ESG risks.

Insurers are now leveraging advanced analytics, artificial intelligence (AI), and real-time data from the Internet of Things (IoT) to build dynamic, forward-looking risk models.

AI-driven underwriting models can analyze vast, complex datasets—including climate projections, satellite imagery, and social indicators—to assess risk with unprecedented accuracy.

Machine learning algorithms are used to identify claims data patterns, predict future losses, and dynamically adjust pricing based on real-time risk factors.

For example, AI-enhanced catastrophe models have improved loss estimation accuracy by up to 40%, enabling insurers to price risk more precisely and avoid adverse selection.

IoT devices, from smart home sensors to vehicle telematics, transform risk assessment by providing continuous, granular data on policyholder behavior and environmental conditions.

Usage-based insurance (UBI) models, which adjust premiums based on actual driving or property usage, incentivize safer and more sustainable behaviors.

In property insurance, smart sensors can detect water leaks or fire hazards early, preventing significant losses and reducing claims.

Insurers are developing climate risk scoring frameworks that integrate environmental, social, and governance factors into underwriting decisions.

This enables them to reward clients who adopt sustainable practices with lower premiums or enhanced coverage, while steering capital away from high-risk, high-carbon activities.

2- Transforming Claims for Sustainability

Claims management is where insurers have the most direct impact on the real world. Every claim is an opportunity to influence how assets are repaired, replaced, or rebuilt—and, by extension, the environmental and social footprint of those actions.

Our course highlights claims fulfillment as one of the biggest levers for driving sustainability in insurance. Insurers are embedding sustainability into claims processes by encouraging the use of recycled materials, promoting repair over replacement, and partnering with vendors who adhere to eco-friendly practices.

For example, Allianz UK collaborates with recycling company SYNETIQ to source green parts from damaged vehicles, reducing waste and emissions.

The adoption of digital tools—such as drones, satellite imagery, and virtual inspections—reduces the need for travel, speeds up claims processing, and minimizes the environmental impact of loss assessments.

AI-powered image analysis can assess property damage remotely, enabling faster and more accurate settlements.

Forward-thinking insurers are fostering ecosystems that accelerate the greening of buildings and infrastructure through claims. By incentivizing sustainable repairs and retrofits, insurers can help policyholders build back better, enhancing resilience to future risks.

Claims data is a goldmine for identifying sustainability opportunities and tracking progress. However, only a minority of insurers currently leverage claims data analysis to drive overall sustainability targets.

The course urges insurers to establish key performance indicators (KPIs) for sustainability at every stage of the claims process and to invest in analytics capabilities that turn data into actionable insights.

3- Risk Modeling for a Sustainable Future

Risk modeling is undergoing a profound transformation as insurers grapple with the complexity of climate and ESG risks. Traditional models, based on historical loss data, are increasingly unreliable in a world of non-linear, systemic risks.

The course advocates for a new generation of risk models that are dynamic, transparent, and aligned with sustainability objectives. Advanced climate analytics, powered by AI and geospatial data, are enabling insurers to model the impact of extreme weather events, sea-level rise, and other climate hazards on their portfolios. These models inform not only underwriting and pricing but also investment and capital allocation decisions.

Insurers are using scenario analysis to assess the resilience of their portfolios under different climate and transition pathways. This helps them identify vulnerabilities, set risk appetites, and develop strategies for managing both physical and transition risks.

Leading insurers are integrating ESG factors into their risk models, recognizing that social and governance risks—such as supply chain disruptions, labor practices, and regulatory changes—can impact claims and profitability. This holistic approach supports the development of sustainable insurance products and investment strategies.

The complexity of sustainability risks demands collaboration across the industry and beyond. Insurers are partnering with technology providers, regulators, and other stakeholders to share data, develop common standards, and build interoperable risk modeling and reporting platforms.

4- Parametric Insurance and Embedded Models

Parametric insurance, which uses predefined triggers such as weather data for swift payouts, is another innovation highlighted in the course. This approach not only ensures faster recovery for policyholders but also promotes resilience in vulnerable communities.

Embedded insurance models are reaching underserved markets, closing the protection gap, and driving financial inclusion.

5- Enabling Climate Investments

The course also explores how insurers can leverage their unique position to enable climate investments. Estimates suggest that insurance could unlock up to $10 trillion in climate-related investments by 2030.

By collaborating with policymakers, innovators, and clients, insurers can create products and services that drive both profitability and positive societal impact.

Real-World Case Studies: Insurers Leading the Way

Throughout the course, participants examine real-world examples of insurers who have successfully embraced sustainability. These case studies demonstrate that sustainability is not only compatible with profitability—it is a catalyst for growth and differentiation.

1- Zurich Insurance Group

Zurich Insurance Group exemplifies what it means to operationalize sustainability at scale. The company has committed to achieving net-zero emissions by 2050, not only in its own operations but across its $200 billion asset portfolio.

Zurich has also pledged to terminate relationships with companies generating more than 30% of revenue from mining, sending a clear signal to the market about the direction of capital flows. These commitments are backed by concrete actions, such as investing in green bonds and supporting renewable energy projects.

Zurich’s approach is holistic: it combines operational efficiency measures to minimize emissions, innovative insurance products for renewable energy, and active engagement with clients and supply chain partners to drive decarbonization.

2- AXA

AXA has positioned itself as a leader in climate risk management, integrating sustainability deeply into its core strategy.

The AXA Climate School, launched in 2015, educates clients and employees on climate risks and adaptation strategies.

AXA has also set ambitious targets to eliminate all global exposure to coal by 2040 and to invest $29 billion into green assets by 2023.

The company’s Progress Index tracks its ESG objectives, ensuring transparency and accountability. AXA’s underwriting policies now exclude new coal projects, and the company is a founding member of the Net-Zero Insurance Alliance, which is developing protocols to measure and disclose insured emissions.

3- Allianz

Allianz, rated AAA for ESG performance by MSCI, has been at the forefront of sustainable investing and product development.

The company is phasing out coal from its insurance portfolios and has committed to reaching net-zero greenhouse gas emissions in its investment portfolio by 2050.

Allianz has invested €4 billion in renewable energy projects and offers discounted premiums for electric and hybrid vehicles, incentivizing sustainable choices among policyholders.

Allianz’s product innovation extends to affordable, tailored insurance for underserved markets, such as crop, credit life, and funeral insurance, supporting financial inclusion and resilience.

4- Swiss Re

Swiss Re has made a 2030 Net Zero commitment for its own operations and aims to decarbonize its underwriting and asset management activities by 2050 fully.

The company has ceased re/insurance for the most carbon-intensive oil and gas companies and invests in carbon offsetting projects.

Swiss Re’s strategic purchase of 1,000 tonnes of carbon removal credits from O.C.O Technology demonstrates its commitment to innovative climate solutions.

Swiss Re is also a strong advocate for climate change awareness and has developed specialized products for renewable energy and climate resilience, such as parametric insurance for natural disasters.

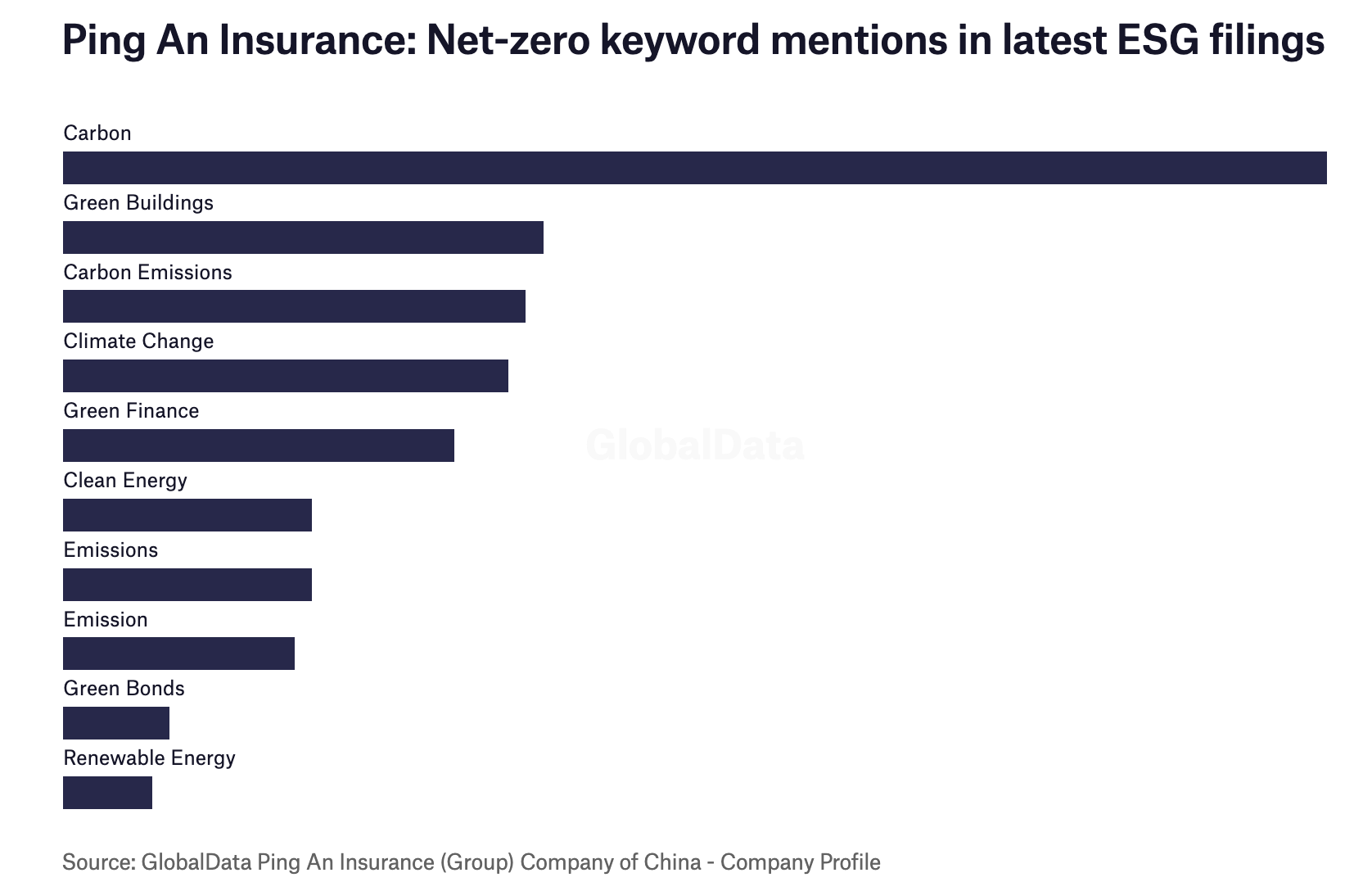

5- Ping An

Ping An, China’s largest insurer, is committed to carbon neutrality by 2030 and has set progressive renewable energy targets, aiming for 100% renewable electricity in operations by that date too.

The company has issued over $61 trillion in sustainable insurance and developed products to support small businesses in rural areas, promoting financial inclusion and sustainable development.

6- Aviva

Aviva has taken bold steps to align its business with sustainability goals, including stopping insurance for companies generating more than 5% of revenues from thermal coal or unconventional fossil fuels.

The company has set a net-zero carbon target by 2040 and is investing in green bonds and sustainable infrastructure.

7- Chubb

Chubb has announced greener underwriting criteria for oil and gas projects, requiring clients to reduce methane emissions.

The company offers green property insurance that covers properties certified by recognized environmental standards, supporting businesses in offsetting their carbon footprint.

8- Kyobo Life Insurance

Kyobo Life Insurance in Korea provides a compelling example of sustainability management through corporate social responsibility (CSR) activities. The company’s initiatives are categorized from the triple bottom line perspective—social, environmental, and economic—demonstrating a holistic approach to value creation.

9- Other Notable Initiatives

Parametric insurance is gaining traction as a tool for closing protection gaps and providing rapid financial relief after disasters. The Mesoamerican Barrier Reef insurance program, for instance, triggers payouts based on hurricane wind speeds, enabling the swift restoration of critical ecosystems.

Public-private partnerships, such as the Flood Re initiative in the UK and California’s Climate Smart Insurance Products Database, are making insurance more affordable and accessible for high-risk properties.

The Human Element: Leadership, Culture, and Collaboration

Embracing sustainability in insurance is as much about people as it is about processes and technology. The course emphasizes the importance of leadership, culture, and collaboration in driving lasting change. Executives are challenged to lead by example, fostering a culture of innovation, transparency, and accountability.

Collaboration is another recurring theme. The course encourages insurers to break down silos, engage with startups and technology partners, and participate in industry-wide initiatives to share knowledge and accelerate progress. By building strong, mutually beneficial partnerships, insurers can amplify their impact and drive systemic change.

The insurance sector’s risk-averse culture is being transformed by open innovation, design thinking, and ecosystem partnerships.

Initiatives like the United Nations Principles for Sustainable Insurance (PSI) and despite losing a few members, the Net-Zero Insurance Alliance are fostering collective action and knowledge sharing.

Lessons From Our Joint Project: Embracing Sustainability in Insurance Course

The course distills several key lessons for insurers seeking to embrace sustainability:

- Start with Purpose: Sustainability must be rooted in the organization's core purpose and values, not just regulatory compliance.

- Operationalize Environmental Drivers: Move beyond box-ticking to embed ESG into every aspect of the business, from underwriting and claims to investments and supply chain management, and focus on a few drivers and initiatives that matter to your customers.

- Leverage Technology: Invest in data, analytics, and digital solutions to enable smarter, more sustainable decision-making.

- Foster a Culture of Innovation: Encourage experimentation, cross-functional collaboration, and continuous learning.

- Engage Stakeholders: Build partnerships with clients, regulators, policymakers, and technology providers to drive systemic change.

- Measure and Report Progress: Use transparent metrics and reporting frameworks to track levers' performance and hold the organization accountable.

The Cost of Inaction: A Slow-Moving Crisis

Perhaps the most compelling argument for embracing sustainability in insurance is the cost of doing nothing. Disregarding sustainability creates deferred costs that accumulate into substantial long-term financial burdens—a slow-moving crisis that erodes financial health over decades.

The financial system itself can act as an amplifier of sustainability risks, with disruptions cascading through supply chains, asset markets, and entire economies.

The long-term financial impacts are measured not only in lost profits for individual firms but in the potential for widespread economic disruption.

As climate change, resource depletion, and social inequality manifest as tangible economic shocks, the insurance industry’s ability to fulfill its core mission—protecting individuals, businesses, and communities from risk—is fundamentally threatened.

Inaction is not a neutral choice but a decision to accept escalating losses, shrinking markets, and growing irrelevance.

Finally...

The insurance industry’s future depends on its ability to embrace sustainability—not as a marketing slogan, but as a strategic imperative woven into the fabric of every decision. The risk of doing nothing is simply too great: Insurers that fail to adapt will face mounting losses, regulatory backlash, and the erosion of their social license to operate. But for those willing to lead, the rewards are substantial: new markets, stronger brands, and a vital role in building a more resilient, equitable, and sustainable world.

Embracing Sustainability in Insurance provides a practical, actionable blueprint for this journey. By learning from real-world successes, leveraging technology, and fostering a culture of innovation and collaboration, insurers can turn sustainability from a challenge into a source of enduring value. The time to act is now—because in the world of insurance, doing nothing is not an option.

Access the course HERE... Enjoy!

Want to know more? Contact us here.

AND join our growing Authentic Identity (and Leaders That Influence) Movement here.