Mind the 1.8 Trillion Gap: Can Parametric Insurance Rewrite Risk?

Sep 03, 2025

Written by Sabine VanderLinden

What keeps an insurance exec up at night? It might just be the protection gap – the staggering divide between what's insured and what isn’t when disaster strikes. For small and medium-sized businesses (SMEs), that gap can mean the difference between bouncing back or closing up shop after a catastrophe. In a witty and insightful conversation, I sat down with Mike Gulla, CEO and co-founder of Adaptive Insurance, to explore the future of insurance and how innovations like parametric and embedded insurance can close that gap. The takeaway: the future of insurance is fast, data-driven, and laser-focused on building resilience.

Why This Matters Now

Insurance was designed to be society’s shock absorber – but the shocks are coming faster and harder than the industry can cushion. In 2024, global catastrophes caused $318 billion in losses, yet only 43% were insured, leaving nearly $181 billion uncovered. This is a devastating result. Over the long term, Munich Re estimates that since 1980, about two-thirds of disaster losses worldwide were uninsured. That means trillions in damage have been shouldered directly by families, businesses, and communities. The Building Codes Save study estimates that $32 billion in losses can be avoided over a 20-year period with modern building codes, highlighting the importance of proactive measures in reducing disaster impacts.

And the risks aren’t slowing. Climate volatility, fragile supply chains, and an aging power grid are turning what used to be “once-in-a-generation” events into everyday threats. In the U.S., power outages have surged 78% over the past decade, costing businesses roughly $150 billion every year. For SMEs running on thin margins, one disruption too many can mean the end of the business. Using natural hazard-resistant building codes prepares communities for natural events like earthquakes, storms, and floods, offering a critical layer of protection against these escalating risks. Community outreach and educational activities can further promote resilience and preparedness by engaging people in understanding building codes and natural hazard safety.

This is why the protection gap isn’t just an industry talking point – it’s an existential challenge. As Mike Gulla of Adaptive Insurance says:

A flood here, a blackout there, a supply chain hiccup – and suddenly the lights go out for good.

The urgency is clear: insurance must evolve from a slow-motion safety net into a real-time resilience engine. Parametric and embedded insurance are fast, transparent, data-driven tools designed to shrink the gap before it swallows the next generation of businesses.

You Will Learn in This Article

This article explores how insurers and business owners can act now to close the protection gap. Whether you’re an insurance executive in London, a startup founder in New York, or an SME owner in Sydney, you’ll take away practical insights and global context, including:

-

Why the protection gap matters now: Fresh data from Swiss Re and Munich Re show how uninsured losses are rising across Europe, the U.S., and Asia.

-

How parametric insurance works in practice: simple, fast, transparent payouts triggered by data, not paperwork.

-

The real impact of climate risks and power outages: why SMEs face rising disruptions, from 78% more outages to $150 billion in annual losses in the U.S. alone.

-

What resilience looks like in 2025 and beyond: how embedding insurance into everyday business processes transforms risk management.

-

Technology at the heart of innovation: the role of AI, cloud platforms, and real-time data in delivering speed, trust, and financial resilience.

-

Action steps for insurers and business owners: how to close the gap, protect revenues, and build resilience before the next disruption hits.

The Future Is Fast (and Parametric)

Parametric insurance is riding in like the cavalry for risk-weary businesses. If you haven’t heard the buzz, parametric insurance is the industry’s answer to a world where speed, transparency, and simplicity are in high demand. Unlike traditional indemnity insurance – which pays out based on the cost of actual damage (often after lengthy claims investigations) – parametric policies pay out a preset amount when a triggering event occurs. That trigger could be an objective parameter like “rainfall above X inches” or “power outage lasting over 12 hours.” No adjusters crawling over your property, no fine-print haggling – if the event meets the threshold, you get paid. Fast. Additionally, parametric insurance eliminates the effect of inflation on the cost of coverage, ensuring predictable and stable financial support for businesses.

Gulla is so passionate about parametric insurance that he reaches outside the insurance box for an analogy:

“I look at parametric insurance as being to the insurance industry what streaming services were to the cable and movie industry 10 to 15 years ago,” he says. Think about that for a second – it’s a Netflix moment for insurance. “When [streaming services] first came on scene, they already existed. Nobody really understood them, and nobody thought that they would take off until the consumer realized that it gave them selection… I didn’t have to buy a 500-channel cable package anymore. I could buy Netflix to watch the three shows I want to watch. What parametric does is a very similar thing,” he explains.

In other words, parametric insurance lets a business choose a coverage that’s laser-focused on a specific risk they care about, rather than a bloated policy bundle filled with things they don’t need.

Just as streaming unlocked choice and on-demand access, parametric coverage unlocks fast, on-demand payouts for the risks that truly matter to a business. It “creates a new product opportunity for the consumer to have access to a different type of coverage that can specifically focus on something that might impact their business,” says Gulla. Crucially, this isn’t replacing traditional insurance – you still need your basic property and liability covers for everyday risks. Instead, parametric insurance fills the gaps and complements those covered. Parametric insurance can also cover excess risks or losses that exceed the limits of traditional insurance policies, acting as an excess layer to help businesses manage exposures beyond their primary coverage. “We’re never gonna circumvent those coverages… What parametric does, again, comes back to allowing the business owner to feel like they’re making a financial investment into a product… that can get them access to capital very quickly,” Gulla notes. It’s that quick access to funds after a disaster, which can mean survival for an SME.

Speed is indeed the killer here. Traditional claims can take weeks or months to adjust and pay – time that a small business simply doesn’t have when, say, a hurricane wipes out their revenue overnight. Parametric payouts, by design, can happen in days or even hours because they’re triggered by data. As Sabine highlights, “Parametric insurance is known for rapid and transparent payout,” which Gulla confirms is by design. He emphasizes knowledge + speed as the twin pillars of resilience:

“The second piece is around speed… How do we use data and technology to drive speed for that business to make an educated decision after an event takes place? This is a great benefit that comes from parametric insurance products… because they are very quick,”

he explains. When your business is reeling from a hit, a claims check in 48 hours beats one in 48 days, hands down.

Real-Time Resilience: Data, AI and the Cloud to the Rescue

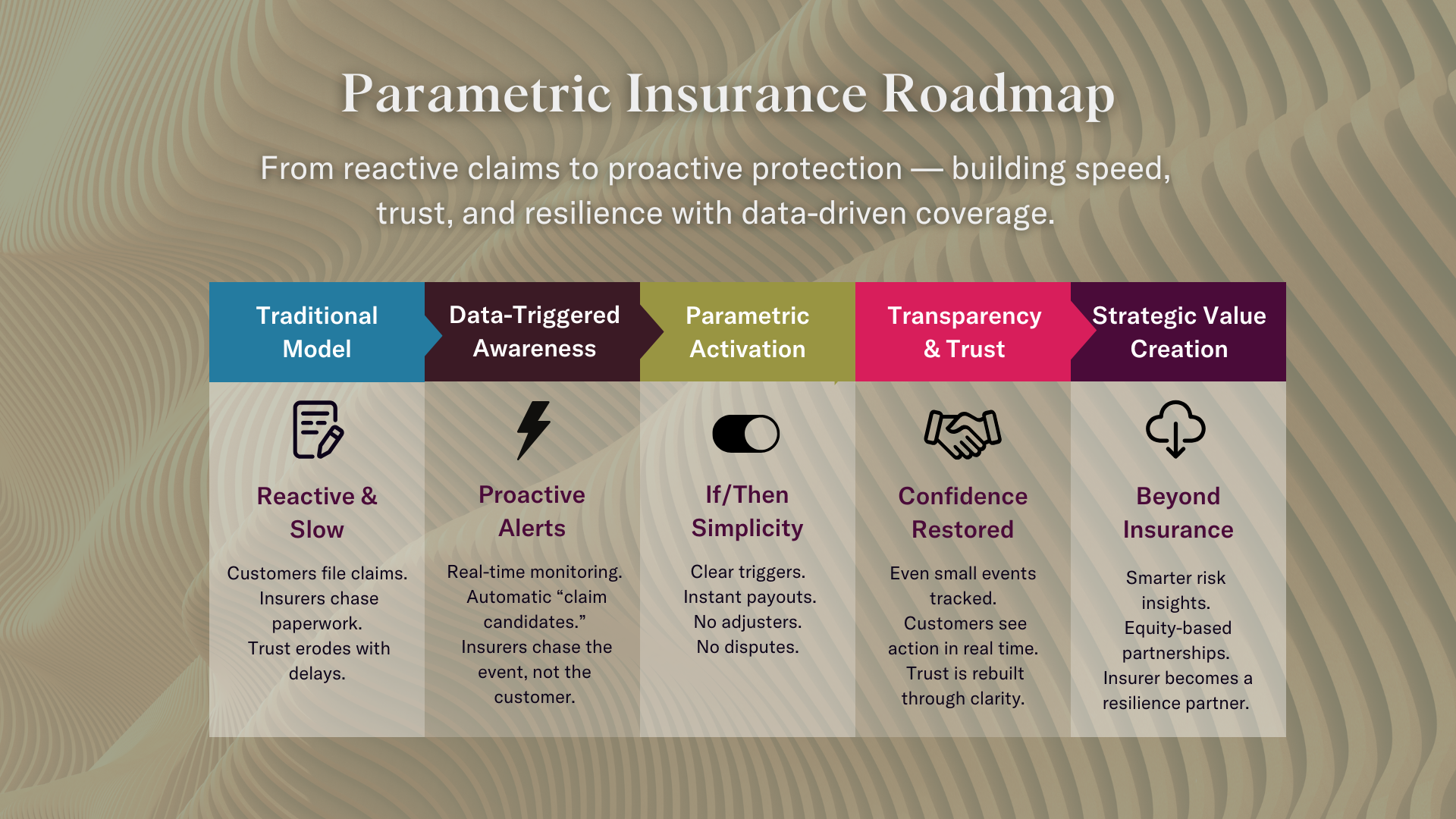

One of the coolest aspects of today's parametric solutions is how they leverage real-time data, artificial intelligence (AI), and cloud infrastructure to turbocharge resilience. Adaptive Insurance, for instance, has built its platform as a “greenfield” tech system – no legacy baggage – which means they can be proactive rather than reactive when bad things happen. Mike Gulla gives a striking example: a severe storm rolled through Minnesota recently, knocking out power for a huge area of Minneapolis. Even before any customers filed a claim (in fact, Adaptive had no insureds in the hardest-hit zone that day), their system sprang into action. “Our technology allowed us to know exactly where those outages were occurring, exactly when they started, how long they were projected [to last] before power was going to come back on,” Gulla recounts. For every outage event, Adaptive automatically creates a “claim candidate” – essentially a proactive alert within their system for any customer in the affected area. They even notify the customer that “we know an event took place and… we’re monitoring it”, essentially telling the client: we’ve got our eye on this, you’re covered. The convergence of insurance with technology creates new investment opportunities in data analytics and risk assessment, further enhancing the industry's ability to innovate and respond.

This changes the traditional model completely. Instead of the customer chasing the insurer, Adaptive’s platform chases the event. “Parametric is essentially an if/then statement – if this happens, then I get that,” Gulla says, breaking it down to basics. “For us, [if] you buy a product that’s a 12-hour outage [coverage]… once it hits a 12-hour outage, you get paid whatever the coverage limit was that you purchased when you bought the policy,” he explains. In the Minnesota scenario, had any of their customers been in the blackout zone, they would’ve been paid out as soon as the power outage crossed the 12-hour mark – no paperwork, no adjusters, no waiting. How’s that for fast relief? And even for shorter outages that don’t hit the trigger, the customer still benefits from the transparency and peace of mind that the insurer is on top of it in real time. It builds trust: as Sabine observes, using the latest tech and data not only makes an insurer “far more responsive to the customer” but also “enables transparency” and builds trust because the client truly understands how the parametric product is going to operate.

It’s evident that technology and data are the engine behind this new wave of insurance. “Everything is technology-first,” Gulla says of Adaptive’s approach. By harnessing cloud computing, IoT sensors, satellite imagery, and AI algorithms, parametric insurers can detect qualifying events instantaneously and measure their impact with precision. The result: no “archaic processes” slowing things down. In Gulla’s words, “The technology is there, the data is there… The connection of technologies on systems now has enabled parametric [insurance] to start to take off”. The industry is taking notice – “the amount of parametric discussions for Adaptive this year versus a year ago [is huge]… Now everybody’s talking about this,” he says. In short, parametric insurance has gone from niche concept to mainstream conversation in a flash, precisely because the tech finally caught up to the idea.

Not Your Grandfather’s Insurance: Embedded Coverage and New Partnerships

Speed and data aren’t the only things reshaping insurance – distribution is also evolving, and embedded insurance is the name of the game. Think of embedded insurance as the “add-on” offer you get at checkout – only instead of extended warranties on a toaster, it’s coverage seamlessly built into the purchase of another product or service. Sabine notes that over 30% of insurance transactions could be embedded within five years, with the embedded insurance market projected to surpass $700 billion by 2029. That’s a tectonic shift in how insurance is sold, and it pairs perfectly with parametric products. “Embedded is the way of the future. This is the consumer experience that everybody wants,” Gulla says matter-of-factly. Today’s customers are used to Amazon-like convenience – “when you go to Amazon and you buy a product, you expect to see the eight other things they recommend for you,” he adds. In other words, consumers don’t want to be sold insurance through a separate, painful process; they want it to come to them as a natural part of whatever they’re already doing.

For insurers and innovators, the question becomes: how do we embed coverage into the customer’s everyday experiences in a way that adds value (and doesn’t feel like a sleazy upsell)? Gulla gives a hint of the possibilities: “For us with power [outage coverage], you could think of a million different embedded distribution opportunities,” he says. Imagine a small business owner installing a backup generator or solar panels – why not offer them an embedded parametric insurance add-on right there, covering any grid outage beyond what their equipment can handle? Or a cloud service for e-commerce merchants that comes with embedded coverage for major IT downtime or cyber outages. The beauty of parametric products, as Gulla points out, is that they’re much easier to embed than traditional policies: “When you think of an embedded product like a parametric, it works so much simpler than a traditional insurance product. It’s much easier to embed because the consumer can understand the value proposition much better… [In] a parametric policy… the driver that really drives the payment is typically much easier for a [business] to understand,” he explains. No 50-page policy of legalese; just a clear trigger and a clear payout. That clarity is key when offering insurance in contexts like retail, telecom, or software platforms – if customers get it at a glance, they’re more likely to opt in.

Embedded + Parametric is a match made in heaven for tackling new risks. Why? Because many emerging risks are highly data-driven and situational. Take power outages, for example – an increasingly common threat with 78% more outages in the last decade and $150 billion in annual losses in the U.S. alone. A restaurant or factory might invest in backup power, but as Gulla notes, “even if you have a backup generator… the impact of grid outages… still has a significant business interruption on your business”. People aren’t coming to your store if the whole neighborhood is dark, even if your lights are on. An embedded parametric policy could be bundled with every generator sale or commercial electricity contract, automatically paying a business when the grid goes down for too long. Or consider supply chain interruptions – an SME might rely on a single overseas supplier; an embedded parametric cover could trigger a payout if that supplier’s region suffers a catastrophe or if shipping times exceed a threshold, providing working capital to tide the business over. These kinds of solutions, delivered at the point of need, can protect businesses from shocks that today often fall in the protection gap (since traditional business interruption insurance might require physical damage or exclude, say, widespread power grid failure).

To make this all work, partnerships will be crucial. Gulla mentions that insurance is a heavily regulated industry, and integrating new tech-driven products means insurers, tech companies, brokers, and even governments need to collaborate. The ecosystem is shifting: tech firms provide the data and distribution channels, insurers provide the risk capacity, and regulators (hopefully) enable these innovations to flourish while protecting consumers.

Everyone has a role. The encouraging news is that big players are on board – even the United Nations has teamed up with insurers on closing the protection gap. (A recent UNDP report with Generali highlighted parametric insurance as “key for closing the US$1.8 trillion protection gap” for climate-vulnerable.) Parametric insurance solutions are particularly beneficial for poor and vulnerable communities in low and middle-income countries, helping them build resilience against natural disaster risks.

Additionally, financial support has been provided to support environmental projects and client needs through these innovative insurance solutions. Engaging communities through education raises awareness about resilience to natural disasters, ensuring that individuals and businesses alike are better prepared for future challenges. The momentum is building to bring these solutions to scale.

Challenges on the Road: What’s Holding Parametric Insurance Back?

Despite the buzz and promise, parametric insurance still faces a bumpy road to mainstream adoption. One of the biggest hurdles is simply getting the word out—many clients, especially in regions like Latin America, aren’t familiar with how parametric insurance works or how it can help them manage risk. This lack of awareness can make customers hesitant to trust or purchase these innovative products, leaving insurers with an uphill battle to explain the value proposition.

On top of that, building effective parametric insurance products isn’t as easy as flipping a switch. Insurers need access to high-quality, real-time data to set accurate triggers and respond quickly when events occur. Gathering and analyzing this data requires significant investment in technology and expertise, which can be a stretch for insurers—especially in countries where digital infrastructure is still developing. The complexity of designing parametric triggers that match real-world risks, and ensuring those triggers are fair and transparent for clients, adds another layer of challenge.

Regulatory uncertainty is another speed bump. In many countries, including those in Latin America, the rules around parametric insurance are still evolving. Insurers must navigate a patchwork of regulations, which can slow down product launches and make it harder to scale. All of this takes time, resources, and a willingness to adapt strategies as the market and regulatory environment shift. But as more insurers and clients see the benefits—and as data and technology continue to improve—the road ahead is likely to get smoother.

Navigating the Rules: The Regulatory Environment for Parametric Insurance

When it comes to regulation, parametric insurance is still finding its place on the global stage. In Europe, regulators are starting to recognize the unique value of parametric products and are working to adapt existing frameworks to support innovation while protecting consumers. Some countries are leading the way with transparent guidelines and open dialogue between insurers and authorities, helping to build trust and encourage new strategies for risk management.

However, in other regions—such as Australia and many Latin American countries—the regulatory environment is still catching up. Insurers operating in these markets must invest significant time and effort to ensure their parametric offerings comply with local laws, which can slow down the rollout of new products. Issues like data privacy, fair pricing, and consumer protection are top of mind for regulators, and insurers need to demonstrate that their products are both transparent and beneficial for customers.

Despite these challenges, there’s growing recognition of parametric insurance's potential to close protection gaps and build more resilient communities. As regulators in Latin America, Australia, and beyond continue to engage with insurers and industry experts, the hope is that clearer, more supportive rules will emerge, making it easier for innovative insurance solutions to reach those who need them most.

Fueling Innovation: Investment and Funding in Parametric Insurance

The momentum behind parametric insurance is being powered by a surge of investment and innovation, especially in the first half of recent years. Venture capital, private equity, and even established insurers are pouring resources into startups and new ventures that are reimagining how risk is managed and covered. This influx of funding is not just about capital—it’s about building the data infrastructure, analytics tools, and technology platforms that make parametric insurance possible.

Advancements in satellite imaging, artificial intelligence, and real-time data collection are enabling insurers to assess risk more accurately and deliver faster payouts to clients. These tools are especially valuable in regions like Latin America, where traditional insurance penetration is low and the protection gap is wide. The recognition of parametric insurance’s potential to reach underserved markets is driving further innovation, with new products and strategies being developed to match the needs of diverse communities.

As investment continues to flow into the sector, expect to see even more creative solutions and partnerships emerge—helping insurers respond to risk in real time and making parametric insurance a key part of the global insurance portfolio.

Spreading the Word: Education and Awareness for Parametric Insurance

For parametric insurance to truly make an impact, education and awareness are essential. Many customers—whether individuals, businesses, or even governments—are still unfamiliar with how parametric insurance works, what risks it can cover, and how it differs from traditional insurance products. Insurers and industry leaders are stepping up their efforts to bridge this knowledge gap, using a variety of tools and strategies to reach clients where they are.

Workshops, webinars, and easy-to-read articles are being rolled out to explain the basics of parametric insurance, while mobile apps and digital platforms are designed to help customers understand their options and select the right coverage for their needs. In countries like Australia, where communities are all too familiar with the impact of natural disasters, these educational initiatives are helping to build trust and encourage adoption of parametric solutions.

By making information accessible and transparent, insurers can empower clients to make informed decisions about risk management. As more people learn about the benefits of parametric insurance—such as rapid payouts and tailored coverage—the industry can close the protection gap and build more resilient communities, one policy at a time.

Time to Close the Gap – Are You In?

The message for insurance leaders and business owners alike is clear: it’s time to mind the gap – and then close it. The old approach of reactive insurance and “fingers crossed” risk management isn’t going to cut it in an era of megastorms, grid failures, and global supply chain snafus. To insurance executives, the call is to embrace these new models – parametric covers, data-driven underwriting, cloud-based claims – not as buzzwords, but as core offerings. They offer a way to insure the “uninsurable” and keep insurance relevant (and valuable) in a changing world. Gulla puts it plainly: the industry has done a great job with traditional products for 200 years, but now we have to add new tools to the toolbox. By “putting those tools together and creating an environment where you can combine insurance products and… technical products into one,” we can give businesses what they really need: financial resilience. It’s about preventing that next climate disaster or cyber outage from knocking your customers out of the game.

To business owners, the message is equally empowering: you no longer have to just cross your fingers and hope your insurer pays up in time. New insurance solutions are emerging that pay faster, more transparently, and for a broader array of perils – from a hurricane down the street to a power blackout or a supplier going offline. These solutions are built for today’s risks. “Knowledge” of your exposures plus “speed” in response are what keep a business running, says Gulla. So ask yourself: do you have the knowledge of what could really hit your business, and the financial backup to respond quickly when it does? If not, it might be time to look into parametric and embedded coverage options that can plug the gaps in your safety net.

The future of insurance, as painted by Mike Gulla and my discussion, is one of proactivity, not reactivity. It’s about insurers using data and AI to anticipate losses and cut checks before you even realize you need them. It’s about buying insurance coverage as seamlessly as you’d add a phone charger to your online shopping cart. It’s about resilience as a service – giving businesses the confidence that even if the sky falls (or the grid fails, or the supply chain snaps), they’ve got a financial life raft at the ready.

I left the conversation with a strong takeaway: The global protection gap isn’t just an abstract figure—it’s your customers, your community, or your own business potentially left exposed. But innovations like parametric and embedded insurance provide a path to bridge that gap, delivering fast, transparent payouts and building resilience in the face of 21st-century risks. As climate change and other emerging threats escalate, these tools are not just nice-to-haves; they’re essential for future-proofing both the insurance industry and the businesses it serves.

So, are you ready to embrace the new era of insurance? It’s already arriving faster than a parametric payout. In the end, closing the protection gap is not only prudent – it’s profitable and it’s the right thing to do. Businesses that survive and thrive through disasters make for stronger long-term customers, and insurers that enable that resilience will lead the pack in the years ahead.

Call to Action: Adapt and Thrive

If this all sounds a bit revolutionary, well, it is – and it’s happening now. Don’t let your organization be the one still using the “weather app on a phone” when others have AI-driven dashboards. Whether you’re an insurer looking to innovate or an SME looking to protect your livelihood, now is the time to explore how parametric and embedded solutions can work for you. Get inspired by Adaptive Insurance’s approach and others in this space. Reach out, ask questions, and consider piloting a parametric product for your key risk exposures. In this example, we see that a combination of insurance know-how and cutting-edge tech can yield solutions that were unimaginable a decade ago.

Ready to adapt? The insurance landscape is changing – fast. Those who embrace data, speed, and customer-centric innovation will not only close the protection gap but unlock new opportunities for growth. In the words of one industry leader who's been spearheading this change:

“Embedded is the way of the future… [Parametric insurance] gives [businesses] access to capital very quickly”.

Interested in learning more?

The future of insurance is being written today. Make sure your business has a seat at the table.

Adaptive Insurance is on a mission to build financial resilience for businesses, helping them close the protection gap before the next disaster strikes. Because “if this happens, then I get that” is far stronger than hoping for the best.

Connect with Mike Gulla to continue the conversation on how your organization can close the gap.

My conversation with Mike on the Scouting for Growth podcast inspired this article, in which he discusses how parametric models are reshaping coverage, delivering transparency, and building real-time trust with customers.

DM us for a short call to explore how Alchemy Crew can help you dive into the latest insurtech breakthroughs – safely, strategically, and impactfully. The insurance revolution is here; with the right approach, you can turn the disruption into your competitive edge.

Contact us here.

FAQs

1. What is the protection gap in insurance?The protection gap is the difference between total economic losses from disasters and the portion that is actually insured. In 2024, global catastrophe losses hit $318 billion, but only 43% were insured, leaving nearly $181 billion uncovered . This gap leaves businesses and economies vulnerable when shocks occur.

2. How does parametric insurance differ from traditional insurance?Traditional insurance pays out after loss assessment and can take weeks or months. Parametric insurance, by contrast, pays a pre-agreed amount when a measurable event (like a 12-hour power outage or a hurricane above a certain wind speed) occurs. It’s fast, transparent, and based on objective data rather than lengthy claims processes .

3. Why should small and medium-sized businesses (SMEs) care about parametric insurance?Because SMEs are often hit hardest by “a thousand cuts” – smaller disruptions like storms, outages, or supply chain delays. These don’t always trigger traditional policies, but they erode cash flow and resilience. Parametric coverage offers quick cash injections to keep operations afloat during disruptions.

4. How can parametric insurance help with power outages?Power outages in the U.S. have risen by 78% in the last decade, causing $150 billion in annual losses . Parametric policies can be triggered by outage duration and location, giving businesses immediate funds to cover losses – even if they have backup power systems but still lose revenue because customers stay away .

5. Is parametric insurance meant to replace existing business insurance?No. As Mike Gulla notes, “We’re never going to circumvent those coverages” . Traditional business owner policies (property, liability, etc.) are essential. Parametric solutions are designed to complement them by filling gaps and speeding up access to capital.

6. What role does embedded insurance play in closing the gap?Embedded insurance integrates coverage directly into a customer’s purchase journey – for example, offering power outage coverage when buying solar panels. With the embedded market projected to exceed $700 billion by 2029, it’s a critical way to scale access to parametric solutions .

7. Are regulators supportive of parametric insurance?Yes – but with caution. Insurance is highly regulated, and innovations must fit legal frameworks. Gulla stresses that compliance comes first, and insurers must build trust with regulators by ensuring transparency, fairness, and consumer protection .

8. How quickly can a business expect a payout with parametric insurance?Payouts can occur within days or even hours, depending on the trigger. Adaptive Insurance, for example, monitors real-time events and can automatically notify and pay customers once a threshold (like a 12-hour outage) is met .

9. How does parametric insurance help with insurance prices?Parametric insurance can offer more stable and predictable prices compared to traditional insurance. By using objective triggers and pre-agreed payouts, it helps businesses manage costs and maintain price certainty, even during periods of market volatility or when insurance prices fluctuate. This stability makes it easier for businesses to plan and budget for risk.