Top Private Business Financing Options: A Guide to Fund Your Venture

May 31, 2025

Written by Sabine VanderLinden

The other day, I was talking to a tech founder who was seeking advice on new funding strategies.

Let's call the founder of the tech startup, David.

Well, David is looking to fund his business without relying on traditional loans.

As we discussed options, I told him that I am shaping a fundraising masterclass to help early-stage founders acquire and self-learn the dos and don'ts of private financing or investor fundraising, having helped so many startups fundraise during my accelerator delivery time (... AND still doing so for the very few, today).

I explained that this masterclass is a bit of a pet project for me.

We are in the world of Democratization of Everything. So why not make this happen digitally? I asked him to give me a few months to complete the digital content with my team. Then we would talk again.

As many people's attention spans are short nowadays, the goal would be to create snackable 120—to 240-second content pieces with clear outcomes that one could learn from while having a bite.

Snakable: Learn while having a break! 😊

So, during our chat, I told David that private business financing offers diverse options, such as angel investors, venture capital, and private equity. I told him to check the white paper I wrote on it... here.

Then, I thought, let's just get some of these alternatives on digital paper so that we can help those of you who need private business financing to research and access the tools to secure the funds you need for growth and success.

Key Takeaways

-

Various private business financing options, including Angel Investors, Venture Capital, and Private Equity, provide unique benefits and considerations for small business growth.

-

Unsecured business lines of credit offer flexibility without collateral, while merchant cash advances (for digital retail or eCommerce businesses) can provide quick access to funds but come with high-interest risks.

-

Self-funding and crowdfunding allow business owners to retain control, though both methods require significant effort and resources to succeed.

Private Business Financing: An Overview

Funding is a crucial financial decision for business owners, often one of the first choices they must make. Determining the amount needed is just the beginning; the next step is securing that funding. Credibly offers flexible and fast business financing solutions tailored to meet the unique needs of each business, determined based on their unique requirements. Not every business will fit into a one-size-fits-all financial solution due to their unique requirements.

Understanding a business’s financial situation and vision influences its financial future. Small Business Investment Companies (SBICs) are privately owned investment funds that invest in qualifying small businesses, offering another layer of potential funding.

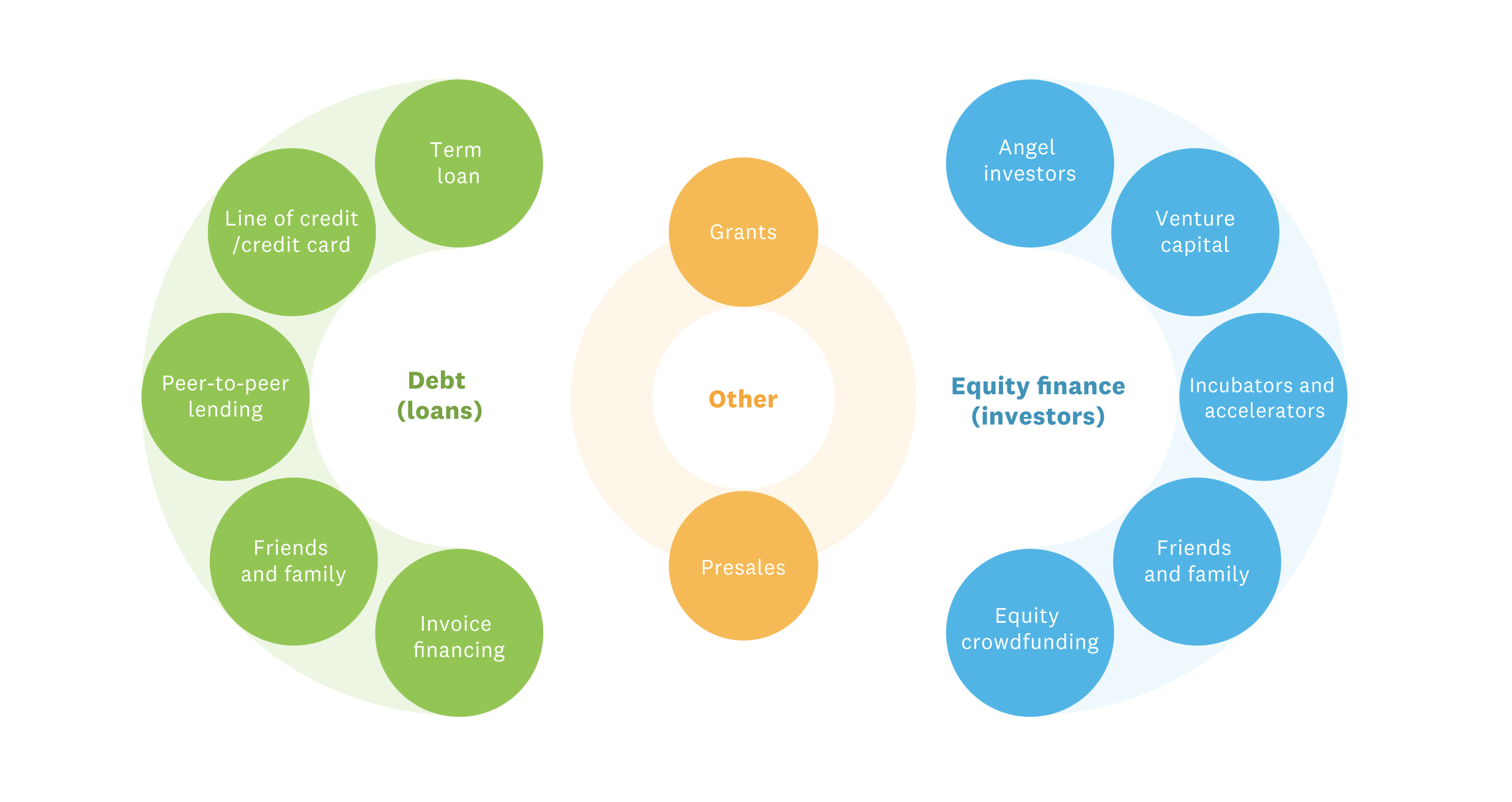

This overview introduces key financing options: Angel Investors, Venture Capital, and Private Equity, each offering unique benefits and considerations. Exploring these options helps small business owners find the best fit for their financial needs. From self-funding to leveraging external investors, the right choice can provide the working capital needed to thrive.

Here are the specifics of each financing method and how they can support business growth.

2025: State of Financing in FinTech

In 2025, FinTech financing is undergoing a strategic recalibration. The era of unchecked growth has given way to a focus on sustainable, revenue-generating models. Investors are prioritizing profitability, regulatory compliance, and scalable operations over rapid expansion. This shift is evident in the rise of revenue-based financing (RBF), which offers non-dilutive capital aligned with a company's cash flow, providing flexibility without sacrificing equity.

Private credit markets have expanded significantly, offering alternatives to traditional bank loans and public markets. These markets provide various funding options, including debt, seed, venture capital, minority stakes, and full buyouts, appealing to companies with high growth potential. The European Union's introduction of the "Scaleup Europe Fund," a €10 billion public-private initiative, aims to support tech startups in scaling and preparing for public listings, addressing the venture capital shortfall in the region.

Mergers and acquisitions (M&A) in FinTech are also experiencing a resurgence. The focus has shifted towards strategic consolidation, operational efficiency, and profitability. Companies are engaging in M&A activities to enhance technological capabilities and solidify regulatory standing, moving away from the speculative growth strategies of the past.

We must admit that, still today, the FinTech financing landscape in 2025 is characterized by a disciplined approach, emphasizing sustainable growth, regulatory compliance, and strategic partnerships. Founders and financial leaders must adapt to this environment by focusing on robust business models and long-term value creation.

Angel Investors

Angel investors are affluent individuals who fund startups in exchange for equity stakes. Unlike venture capital firms, they typically use personal wealth to finance businesses. This type of investment is crucial for small businesses in the seed and startup stages, providing the capital needed to get off the ground. In 2020 alone, angel-funded businesses received $25.3 billion in investments, underscoring their importance.

Angel investors often seek an exit strategy, such as an acquisition or public offering, to realize their profits. While this can provide significant funding, it also means that small business owners must be prepared to share control of their company. Despite this, the expertise and network that angel investors bring can be invaluable for business growth.

Venture Capital

Venture capital is a powerful financing option for businesses looking to scale rapidly. The process follows a standard order of basic steps, starting with pitching to venture capitalists and culminating in negotiations and agreements. However, business owners must be prepared to give up some control and ownership.

Venture capitalists often require ownership share and may seek an active role in the company. A common requirement from venture capitalists is for a seat on the board of directors, ensuring they have a say in the company’s strategic direction. This involvement can drive significant growth and profitability, but it also means that business owners need to be comfortable with external influence on their operations.

Private Equity

Private equity firms take an active role in managing the businesses they invest in, aiming to enhance growth and profitability. They engage deeply with their portfolio companies, driving operational improvements and strategic growth. This hands-on approach can lead to substantial business transformation but requires a willingness to share control and decision-making.

A common condition for private equity funding is that the investor requires a seat on the company’s board of directors and expects equity in exchange for their investment. This aligns the interests of the business and the investor, fostering a partnership aimed at achieving mutual success.

Unsecured Business Lines of Credit

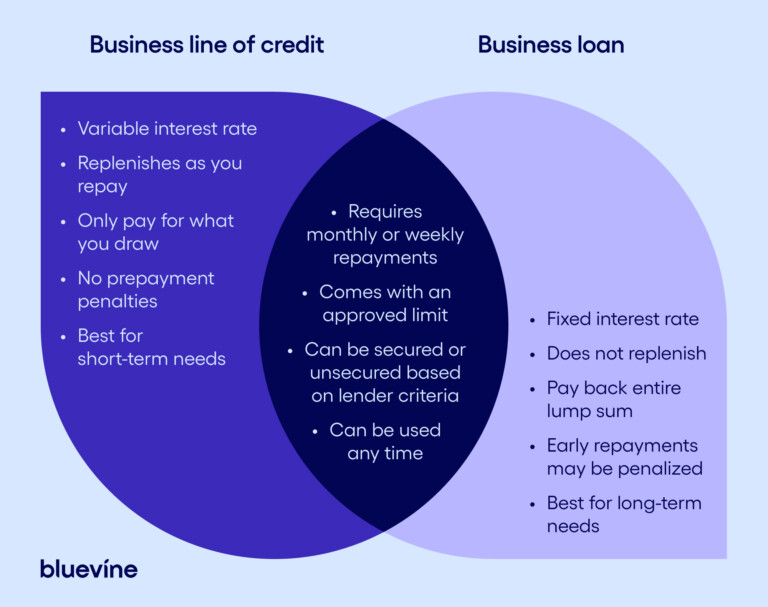

An unsecured business line of credit can be utilized without collateral, providing flexibility in cash management. This type of credit is cost-effective as interest is only charged on the amount used. Small business owners often find this option appealing because it helps manage cash flow by bridging gaps between payables and receivables. An unsecured line can further enhance this flexibility, especially when considering additional collateral.

Qualifying for an unsecured business line of credit typically requires demonstrating at least $100,000 in annual revenue and meeting the eligibility requirements. The approval process involves reviewing both personal and business financials to ensure the business can meet its credit obligations.

This financing option is ideal for businesses looking for flexible, short-term loans, working capital solutions, and other financing options.

Merchant Cash Advances

For those with eCommerce proposition, merchant cash advances provide upfront capital in exchange for a portion of future credit card sales.

Key features include:

-

Suitable for businesses with seasonal and fluctuating revenue

-

Repayment is linked to daily credit card sales, allowing for flexible payment amounts

-

The repayment percentage generally ranges from 10% to 20% of daily credit card income

-

Adaptable to the business’s cash flow

However, high-interest rates for merchant cash advances can exceed 350% APR, posing significant financial risks. These advances are evaluated based on business cash flow rather than traditional credit scores or collateral, making them accessible to businesses that may not qualify for conventional loans. The interest rate for these advances can be quite daunting.

Equipment Financing Options

Equipment financing allows businesses to acquire necessary equipment without impacting cash flow. It is primarily used for:

-

Purchasing or leasing essential equipment (think about your SME drilling or farming equipment)

-

Short-term specific loans for equipment repair

-

Replacement of equipment

-

Purchase of equipment

This provides flexibility in managing business needs.

Flexible payment plans, including monthly payments, quarterly, or annual options, enable businesses to manage costs effectively. Additionally, no down payment is typically required, making it easier for companies to retain cash flow and money.

Additional costs, such as installation and taxes, can often be included in the financing agreement, providing comprehensive support for equipment acquisition.

Crowdfunding for Businesses

Crowdfunding is popular among business owners because:

-

It is low risk.

-

It allows them to retain full control of their company.

-

It enables businesses to secure funding without the barriers often found in traditional financing methods.

-

Successful crowdfunding campaigns can validate market interest and enhance visibility for a product or service.

Certain crowdfunding models allow entrepreneurs to retain full ownership while raising capital. However, crowdfunding can be resource-intensive, requiring significant effort in marketing and engagement to succeed. The competitive nature of crowdfunding means that only a small percentage of campaigns reach their funding goals.

Self-Funding Your Business

Self-funding, or bootstrapping, allows entrepreneurs to maintain full ownership without diluting equity. While this approach provides complete control, self-funded businesses often face challenges in establishing credibility without external investors. Bootstrapping can also lead to slower growth due to limited resources and marketing budgets.

Successful bootstrapping involves identifying cost-cutting strategies to maximize resources. Networking is crucial for building customer bases and finding collaborators.

Despite the challenges, self-funding can be a viable option for those willing to take on the risk and responsibility.

SBA Loans and Traditional Bank Loans

Eligibility for SBA loans generally includes:

-

More lenient criteria, accommodating businesses that may not qualify for conventional financing

-

Lower down payment requirements compared to traditional bank loans

-

Repayment terms extending up to 25 years for an sba loan

However, the application process for SBA loans can be more complex and time-consuming.

Conventional loans, offered by financial institutions without government backing, often require higher credit standards. They may provide quicker funding options for businesses with strong credit histories.

Both small business administration SBA and traditional bank loans have their merits, and the choice depends on the specific needs and qualifications of the bank loan business.

Using Financial Advisors for Business Financing

Financial advisors:

-

Enhance investment strategies and ensure growth and stability in business financing.

-

Provide guidance on insurance needs tailored to specific business requirements.

-

Facilitate employee benefits planning, which can help attract and retain talent.

Reviewing contractual obligations with a financial advisor can help avoid potential financial pitfalls. They also play a critical role in succession planning, ensuring a smooth transition of ownership when needed. Engaging a financial advisor provides comprehensive support for a business’s financial health and future growth.

Pre-Qualifying for Private Business Loans

Pre-qualifying for a private business loan involves:

-

Gathering necessary documents

-

Preparing a solid business plan that outlines how the loan will be used and the strategy for repayment

-

Providing financial statements, such as profit and loss reports, to assess the business’s financial health

Having a good credit score can significantly increase the chances of credit approval for a business loan. Lenders typically prefer businesses that have been operating for at least two years and may require collateral or a personal guarantee for larger loan amounts. Additionally, maintaining good credits can further enhance a business’s financial profile.

Online lenders often have less stringent requirements, focusing more on cash flow rather than credit scores.

Approval and Funding Timelines

Banks typically approve small business loans in at least a week. Loan processing times can differ significantly based on the lender and loan type. After approval, SBA loans may take 30 to 90 days to provide funds.

Some online lenders fund short-term working capital loans within a week or even the next day. Applying for loans early in the week can facilitate quicker processing compared to applying close to weekends or holidays. Understanding these timelines can help businesses plan their financing needs more effectively.

What Does This Mean?

Securing the right financing is crucial for the success and growth of any business. From angel investors and venture capital to SBA loans and merchant cash advances, each financing option offers unique benefits and challenges. Understanding these options and how they align with your business needs can empower you to make informed decisions. Choose the right funding path to fuel your business growth and achieve financial stability.

Want to know more? Contact us here.

Frequently Asked Questions

What are the benefits of using angel investors for business financing?

Utilizing angel investors for business financing offers essential early-stage funding while also granting access to valuable expertise and industry networks, although it typically requires giving up equity. This dual benefit can significantly enhance the growth potential of a startup.

How does venture capital differ from private equity?

Venture capital differs from private equity primarily in that it invests in early-stage companies with significant growth potential, whereas private equity targets established businesses that require active management to enhance their value.

What are the main advantages of an unsecured business line of credit?

The main advantage of an unsecured business line of credit is its flexibility in cash management, requiring no collateral and only charging interest on the utilized amount. This can be particularly beneficial for businesses needing quick access to funds without tying up assets.

What should businesses consider before opting for crowdfunding?

Businesses should carefully consider the substantial marketing efforts and engagement required, along with the financial and legal obligations associated with crowdfunding. These factors are critical to ensure a successful campaign.

How do SBA loans compare to traditional bank loans?

SBA loans offer more lenient eligibility requirements and longer repayment terms than traditional bank loans, though they entail a more complicated application process. This makes SBA loans a suitable option for those who may face challenges qualifying for conventional financing.