From Fragmentation to Transformation: Four Scenarios Shaping Insurance 2040

Jul 03, 2025

Written by Sabine VanderLinden

- Four scenarios define insurance's $145 billion climate-driven transformation by 2040: From fragmented markets where tech protectionism and missed climate goals widen protection gaps, to customer-centered transformation where AI-powered preventive services reduce claims by 20%, selective climate resilience where parametric bonds surge from $600M to $1.4B annually, and polycrisis where converging disasters threaten industry collapse—each path demanding radically different strategic responses from insurers.

- Global cooperation levels and technological advancement rates create insurance industry inflection points: Low cooperation despite rapid tech yields hyper-regionalized markets with luxury-priced coverage, while high cooperation enables mid-sized insurers to leverage AI for personalized usage-based policies—with companies like State Farm deploying smart plugs, Chubb selling water leak detectors, and Bajaj Allianz launching parametric heat wave coverage as early indicators of which future is emerging.

- SAS Viya and advanced analytics platforms enable insurers to navigate all 2040 scenarios through three capabilities: Dynamic risk modeling that simulates climate and cyber threats in real-time, AI-driven decision engines processing streaming data for instant underwriting adjustments, and unified analytics ecosystems breaking down silos—essential as 99% of U.S. insurers now model climate scenarios while facing $110 billion quarterly disaster losses that demand unprecedented agility and foresight.

Introduction

As we look toward 2040, the insurance industry stands at a crossroads shaped by rapid technological advances, shifting global dynamics, and escalating climate challenges. The future is uncertain, marked by a range of possible paths that could redefine how insurance operates and serves customers worldwide. This paper explores four distinct scenarios that envision how the industry might evolve over the next two decades.

These scenarios—from a fragmented world marked by inequality to a future driven by customer-centered innovation, selective climate resilience, and a complex polycrisis—offer a framework to understand potential risks and opportunities. Each scenario provides a unique context for understanding how digital transformation and global trends may impact the insurance industry.

By examining these plausible futures, insurers can better prepare strategies that are adaptable, resilient, and aligned with emerging global trends. These scenarios represent different stages the industry could pass through on the way to 2040. Each scenario highlights different drivers such as technology adoption, international cooperation, and environmental pressures, illustrating the diverse ways the insurance landscape could transform. This exploration serves as a guide for industry leaders to navigate uncertainty and shape a sustainable, inclusive future and potentially improve their decision-making process.

As insurers plan for these scenarios, they may set quantifiable goals, such as reducing the protection gap or increasing resilience, to measure progress and success.

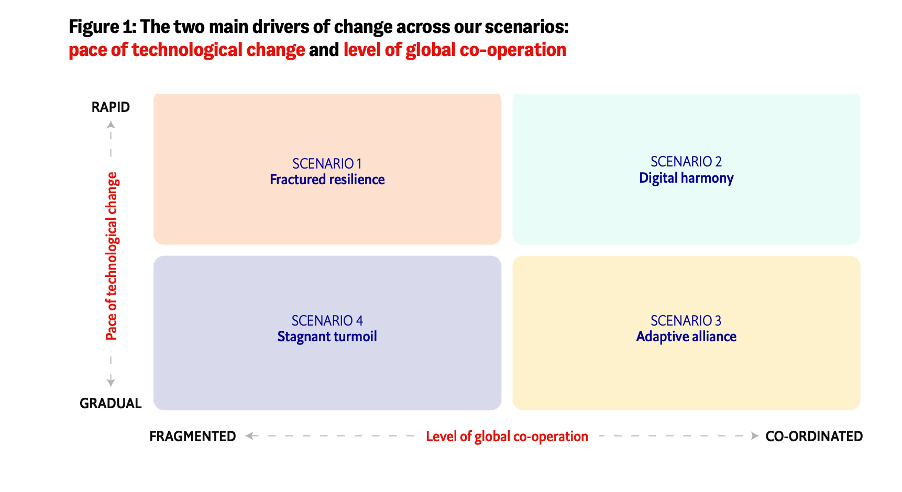

Source: This chart comes from SAS + The Economist Study

Let’s get started…

Adaptation in a Fragmented, Unequal World

Imagine the year 2040 in a world splintered by national interests. Breakthroughs in AI and other technologies have fueled growth for those who can afford them, but global cooperation has unraveled.

In this scenario, climate goals are missed amid discord, and only a handful of wealthy countries deploy green innovations while poorer regions suffer worsening floods and fire. Insurance, once a universal safety net, has become a luxury. Markets turn “hyper-regionalized,” with large disparities in pricing and coverage. Limited access to secure online accounts and computers further exacerbates inequality in these fragmented markets, making it even harder for vulnerable populations to participate in the digital economy.

The result? A widening protection gap as insurers retreat from high-risk areas, leaving vulnerable populations without support. Citizens in these regions are left without access to essential insurance services, further deepening inequality and limiting their ability to recover from disasters. Many individuals in poorer regions may also lack the devices and internet connectivity needed to access modern insurance services, compounding their exclusion.

Adaptation in a Fragmented, Unequal World is the most provocative path outlined by a new SAS–Economist Impact study – a stark vision of unchecked tech progress in a fractured global order.

This isn’t dystopian fiction though. It’s one of four plausible futures from Revealing the Paths to 2040: Four Possible Scenarios for Insurance.

As the study cautions us all “Our scenarios are not intended to predict the future,” but to explore how different choices play out, helping insurers “better position themselves to respond effectively to emerging challenges and seize new opportunities.”

In fragmented environments, individuals and organizations face increased cyber risks, as it becomes more difficult to protect their accounts and devices from cyber threats.

In other words, these scenarios are thought exercises to stress-test strategies. They center on two critical uncertainties – the level of global cooperation and the pace of technological change, which will define how well the industry and society tackle issues like climate change and protection gaps.

Scenario 1 assumes low cooperation despite rapid tech advances, yielding a fragmented, unequal world. Unfortunately, today’s headlines make this scenario seem eerily plausible: geopolitical tensions are high, tech protectionism is rising, and national priorities often sideline climate action. The seeds of fragmentation are already around us.

In the news:

- In late May 2025, the U.S. Commerce Department ordered a broad range of tech companies to stop shipping advanced tech goods to China without a license. This move revoked existing export licenses for specific suppliers and targeted choke-point technologies vital to China’s tech sector. Products now requiring special export licenses include semiconductor design software (EDA tools), chipmaking chemicals, industrial machine tools, and even some aviation components. Major U.S. EDA software firms – Cadence, Synopsys, and Siemens EDA – were notified that any sales to Chinese clients need case-by-case U.S. approval. These curbs, aimed at stalling China’s semiconductor advancement, immediately hit those companies’ stock prices and operations (Synopsys even suspended its forecasts due to the uncertainty).

- EU AI Act (2024–2025): The European Union has taken a regulatory approach to tech governance, notably through the EU AI Act, which was adopted in mid-2024 as the world’s first comprehensive AI law. The AI Act entered into force on 1 August 2024 and will apply fully by 2026, imposing a strict compliance regime on AI systems. It bans “unacceptable-risk” AI practices outright (for example, AI for social scoring, manipulative subliminal techniques, or real-time biometric ID in public spaces are prohibited). It also defines “high-risk” AI categories (like AI in critical infrastructure, hiring, credit scoring, law enforcement, etc.) that face strict obligations before deployment. Providers of such AI in Europe must implement risk assessments, transparency, human oversight, and even submit to audits. Some provisions have already kicked in – as of February 2025, the ban on specific AI uses is legally in effect, and by August 2025, additional rules on foundation models (e.g., requiring disclosure of AI-generated content and copyrighted data) will start applying. The EU’s hardline stance on AI governance means companies from abroad must tailor and potentially restrict their AI offerings to meet European standards, contributing to regulatory fragmentation. For instance, an AI system deemed acceptable in the U.S. or Asia might be illegal or heavily regulated in Europe, forcing separate product versions or geofenced services.

- Apple Shifts Production from China (2025): Fearing future trade barriers, Apple Inc. decided to accelerate relocating its manufacturing for U.S.-bound iPhones out of China. In April 2025, it was reported that Apple plans to source the majority of iPhones sold in the U.S. from factories in India by 2026, a dramatic pivot from its long-time production base in China. Apple’s urgent talks with its suppliers (Foxconn, Tata) were driven by the threat of soaring U.S. tariffs on China. At the time, U.S. tariffs on Chinese electronics were poised to exceed 100%, whereas imports from India faced much lower duties. By moving assembly to India (despite slightly higher costs there), Apple is hedging against geopolitical risk and tariff walls. This shift underscores a broader trend of supply-chain “decoupling”: other electronics OEMs and semiconductor firms likewise invest in alternative manufacturing sites (India, Vietnam, U.S., Mexico) to reduce dependence on China if the U.S.–China tech rift widens.

Customer-Centered Transformation to Meet Customer Needs

In stark contrast, another scenario envisions a future where collaboration and trust reignite progress. Customer-Centered Transformation imagines a 2040 defined by high global cooperation and fast innovation.

Here, governments agree on data privacy and digital standards, opening channels for collective technological advancement. Users expect seamless insurance experiences across any device, from smartphones to computers, driving insurers to innovate across platforms. Insurers shift from being mere claim-payers to proactive risk preventers – moving “from an indemnification to a preventative approach” in areas like health, home, and auto coverage. With common standard rules and shared data, technology becomes democratized.

Even mid-sized insurers harness AI to offer personalized, usage-based policies, reaching customer segments previously underserved. In this optimistic world, the insurance protection gap narrows as emerging markets leapfrog with accessible insurtech solutions. Preventive healthcare and climate adaptation solutions flourish because everyone works from the same playbook.

This cooperative scenario underscores what’s possible when global forces align. We get glimpses of this future today whenever nations come together – for instance, in joint climate accords or interoperable digital regulations. Insurers leverage their websites as digital hubs to engage customers and deliver personalized services.

Executives should ask: if the world moves toward greater openness and shared innovation, are we ready to capitalize on it? Insurers in this scenario win by embracing analytics and partnerships that tailor offerings to customer needs at scale, using insights to drive innovation and product development.

Advanced content production workflows enable insurers to communicate with customers and streamline digital processes efficiently. The conversational tone of Scenario 2 is hopeful: it’s about earning customer trust and making insurance not just a safety net but a proactive service embedded in daily life.

For strategists, it’s a reminder that siloed thinking won’t thrive if tomorrow’s customers expect seamless, preventive protection. Digital transformation allows insurers to grow their customer base and expand into new markets.

In the news:

- Insurity’s 2025 AI in Insurance Report found that 45% of consumers are comfortable with insurers using AI to issue real-time severe-weather alerts—such as warnings of flash floods or high winds—although concerns over premium impacts remain. By translating weather risk into real-time action, insurers are moving closer to being proactive guardians, not just passive payers.

- An FT piece signaled a new wave of proactive services: State Farm offers free smart plugs to detect electrical faults. Chubb sells water leak detectors and rewards customers who install them. Manulife incentivizes health—from fitness trackers to cancer screening support. These initiatives scaled significantly in 2025, with insurers now delivering sensors, recommendations, and real-time monitoring—shifting the narrative from “pay-after-loss” to “prevent-before-damage.”

- Multiple property carriers in Europe are piloting AI-driven prevention platforms that use IoT sensors plus AI models to monitor home conditions (humidity, pipe pressure, intrusion). These systems alert customers, send tips, and even dispatch maintenance before severe damage occurs. Starting in May 2025, such tools are being embedded into policy bundles, testing early success in reducing small claims by ~20%.

- Commercial insurers are stepping into a consulting role. In May 2025, multiple U.S. carriers began offering infrared inspections of wiring in small businesses, detecting hotspots before fires ignite. Another insurer now provides cyber hygiene dashboards and proactive alerts to mid-sized clients, identifying exposed ports and log anomalies before breaches happen. It's part of a growing portfolio of risk-prevention services bundled with coverage.

Climate Resilience for Some

Not every future is all good or all bad. Insurers Spur Climate Resilience – the third scenario – is a world midway between crisis and cooperation. By 2040, climate change’s physical impacts will have intensified, forcing action. Effective planning for climate resilience and integrating digital tools into strategic decision-making are now essential for organizations to adapt.

Major economies respond with tough sustainability rules and revamped disaster policies, leaning on insurers’ risk models to guide decisions. In wealthier regions, banks require climate-adjusted mortgages, and insurers reward homeowners who fortify properties against floods and fires. These measures pay off with more resilient communities – but only for some.

Less affluent countries lack resources and focus on immediate disaster response over long-term adaptation. The UK Climate Resilience Programme quantified UK climate risk and built resilience, showcasing how targeted initiatives can address vulnerabilities. Using advanced analytics and troves of historical data, private insurers reprice risk and sometimes withdraw coverage where threats become uninsurable. When markets fail, governments step in with stricter building codes and public insurance schemes.

This scenario paints a picture of uneven resilience: progress in pockets, persistent vulnerability elsewhere. It resonates with our current reality – think of the disparate impacts of climate events already visible between developed and developing nations.

Insurers increasingly use digital environments, such as digital twins, to simulate climate risks and optimize adaptation strategies. The silver lining is the starring role insurers can play if they seize the moment. By investing in climate analytics and collaborating on adaptation efforts, often through targeted projects aimed at building resilience in vulnerable regions, insurers can be catalysts for resilience. Cybersecurity is crucial to protecting sensitive data in the insurance industry, ensuring that these efforts are not undermined by breaches or unauthorized access. But if they don’t, they may face a future where, as one SAS expert put it, “there is a non-zero chance the insurance industry will collapse by 2040” due to unmanageable risk exposure.

To support these analytics and risk modeling efforts, insurers must store large volumes of climate data in reliable systems that ensure secure and consistent access. The lesson for leaders? Climate risk isn’t tomorrow’s problem – it’s here now, and how insurers respond (or don’t) will shape their survival.

- Advanced analytics produce actionable insights that help insurers and policymakers respond to climate threats more effectively.

- Process optimization also reduces waste in claims management and disaster response, improving efficiency and lowering costs.

- Digital transformation is reshaping traditional office operations in the insurance industry, integrating new technologies into workplace infrastructure and processes.

In the news:

- According to FT (May 22, 2025), parametric catastrophe bonds issuance, which deliver swift payouts based on event triggers, soared from $600 M to $1.4 B year-over-year. Companies like Descartes Underwriting and Generali are scaling parametric solutions for clients including wind farms, utilities, farmers, and industries—especially in locations where traditional insurance has priced out buyers.

- On June 4, 2025, Ceres reported that 99% of U.S. insurers now disclose climate risk, while over 148 groups are running climate scenario modeling, up from 116 in 2022. Although gaps remain, the momentum reveals insurers recognizing and preparing for physical risks—transcending talk to integrate climate resilience into strategy.

- On June 10, 2025, Bajaj Allianz launched short-term parametric insurance products in Kolkata covering extreme heat, cold waves, and heavy rainfall, activated by real-time triggers such as temperature thresholds from the national weather agency, with ~650 policies sold immediately. ICICI Lombard and National Insurance are preparing to release similar products. The aim is to offset household and microbusiness losses from climate shocks, shifting insurers toward active protection rather than reactive payout.s

- A U.S. pilot, backed by Munich Re and the Mississippi River Cities & Towns Initiative (MRCTI), is deploying parametric flood insurance. It promises rapid payouts linked to defined water-level triggers, without lengthy claims adjustments. This tackles faster recovery and flood resilience in vulnerable rural communities.

Polycrisis: A Struggle to Adapt

The final scenario is a sobering worst-case: a polycrisis world where everything that can go wrong, does. In this 2040, geopolitical strife and innovation stagnation feed off each other. Governments and businesses refuse to collaborate; protectionism and mistrust limit technological progress.

The “full potential of AI fails to materialize, and the insurance industry falls behind in adapting to a world beset by increasingly catastrophic natural disasters.” Without unified action on climate or cyber threats, crises compound. Economic gains expected from tech revolutions never fully arrive as major powers turn inward, hampering growth.

The insurance sector, strained by constant shocks, teeters under the pressure. The protection gap reaches historic highs, hitting emerging markets hardest and leaving millions without a safety net.

Insurers must lead efforts to adapt to compounding crises, but the lack of coordination makes this problematic. Eventually, traditional insurance models and established insurance systems falter; in their place, communities improvise local risk pools to survive. Building new, resilient systems to address emerging risks proves challenging in this fragmented environment.

If Scenario 1 was a wake-up call, Scenario 4 is a five-alarm fire. It warns of an industry overwhelmed by converging crises – a plausible outcome if current polycrisis-like trends escalate. Consider the past few years: a global pandemic, supply chain breakdowns, a war in Europe, surging inflation, unprecedented cyberattacks, and record-smashing natural disasters all happening concurrently. Insurance systems must withstand extreme stress and uncertainty, testing their resilience like never before.

It’s a vivid illustration of compounding risks. For insurance executives, the takeaway is clear: the status quo is unsustainable. In a polycrisis future, simply reacting is a losing game. Technology has the power to support and enhance insurance operations, but its impact is limited in a fragmented world. Avoiding this fate means building much more adaptive, forward-looking organizations today.

The industry is transforming in response to polycrisis, with new risk and data management approaches, but progress remains slow and uneven.

Declining revenue is a significant challenge for insurers in this scenario, as traditional business models struggle to keep pace with escalating risks and reduced growth opportunities.

Even advanced technologies like self-driving cars, which could improve safety and efficiency, fail to deliver their full benefits due to insufficient collaboration and investment.

In the news:

- Insured losses from extreme weather are projected to hit $145 billion in 2025—a 6 % increase year-over-year—with wildfires near Los Angeles expected to drive much of the spike, and hurricanes and floods showing rising frequency and severity. In just the first quarter of 2025, natural disaster losses totaled over $110 billion, nearly double the 10-year seasonal average. This unrelenting cascade of disasters pressures insurers to raise premiums, shrink coverage zones, or exit markets—a scale of stress that matches the “polycrisis” vision of a system stretched beyond its limits.

- In the U.S., insurers are increasingly abandoning homeowners in high-risk areas—wildfires, tornadoes, hurricanes—creating insurance voids and elevating financial instability for consumers. The U.S. homeowners insurance market faces escalating premiums and dwindling availability, forcing many policyholders into either high-cost alternatives or leaving them uninsured.

- The World Bank downgraded its global growth forecast to 2.3 % in 2025—the slowest non‑recession pace since 2008—citing trade restrictions, geopolitical uncertainty, climate disasters, and high debt. The European Central Bank, in its May 2025 Financial Stability Review, flagged fragmented trade, policy uncertainty, mounting geopolitical risks, cyber threats, and climate-induced vulnerabilities as compounding threats to financial stability.

- Despite its potential, AI-driven innovation is overshadowed by crises. Cyber threats, trade fragmentation, and sluggish productivity are undermining AI integration and expansion. The multiplication of natural disasters is pushing insurers to shift resources away from innovation and towards claims and capital rebalancing, slowing AI investment in underwriting, risk modeling, and response systems.

Navigating Uncertainty with Analytics and Agility

Faced with these divergent futures—from fragmentation to transformation—insurance leaders must balance bold vision with practical preparedness. None of the four scenarios is guaranteed, but elements of each are already visible, as shown by the news snippets shared.

This puts the onus on insurers to plan for extreme uncertainty.

As Franklin Manchester, SAS’s global insurance advisor, bluntly observed:

“insurers should take stock of growing risks and their overall resilience now, before it’s too late."

It’s a call to action to rethink strategy, investments, and partnerships with a 15-year horizon.

The encouraging news? Insurers are not flying blind into 2040. Advanced analytics and AI have matured just in time to serve as a compass in chaos. Reflecting on how far traditional models are being stretched, we must recognise that “even the boldest actuaries… could hardly have imagined the recent explosion of loss events.

AI will become an indispensable tool—albeit one guided by human expertise—for insurers to survive and thrive. Adopting a hybrid multi-cloud infrastructure provides access to the best digital tools and technologies as they emerge, further enhancing the industry's ability to adapt to future challenges.

To navigate whichever path becomes reality, firms must cultivate adaptability through technology. This is where platforms like SAS Viya become critical. SAS Viya is a cloud-native analytics platform that enables digital transformation by providing robust cloud and analytics infrastructure.

Digital transformation is a business strategy initiative incorporating digital technology across all areas of an organization. This infrastructure is essential for supporting large-scale data management, security, and the adoption of new technologies. These platforms also help optimize operations for insurers, enabling them to modernize processes and improve agility.

SAS Viya enables businesses to deliver:

- Dynamic Risk Modeling: Continuously updated models that ingest new data (from climate sensors to social trends) and simulate countless what-if scenarios. This helps insurers price risk more fluidly and foresee emerging threats, whether in a stable market or a volatile polycrisis.

- Real-Time Decision Intelligence: Artificial intelligence-driven decision engines that can analyze streaming data and recommend actions instantly. From flagging a cyber breach as it unfolds to adjusting underwriting criteria on the fly, real-time analytics turn rapid response into a competitive advantage.

- Organizational Agility: A unified analytics ecosystem that breaks down silos. By connecting data, people and processes on one platform, SAS Viya helps insurers pivot quickly, be it launching a new parametric insurance product or rebalancing portfolios as market conditions shift. Digital transformation enables organizations to innovate products and processes continually. This integration improves efficiency in business operations, allowing insurers to respond faster and optimize performance.

Ultimately, preparing for 2040 isn’t about picking a scenario—it’s about building the muscles to excel in any scenario. The future might bring fragmentation, customer-centric transformation, selective climate resilience or a full-blown polycrisis. Most likely, it will surprise us with elements of all four. By investing in decision intelligence, advanced modeling and agile culture today, insurers can confidently stride into uncertainty.

Advanced analytics and technology support insurers in meeting future challenges, ensuring they are equipped to adapt and thrive. Whatever the world throws at us by 2040, the industry’s mandate remains the same: protect people and businesses when they need it most. With foresight and the right tools at hand, that mission can endure in every possible future.

Want to know more…

You can download the full report Here.

You can read more about SAS's AI and Analytics Solutions for Insurance if you'd like to learn more about each of them Here.