The Venture Client Model Readiness Assessment

Sep 26, 2025

- Venture-client deployment readiness assessment reduces AI pilot failure rates from 88% to 18% through systematic evaluation. CIOs and CTOs using structured readiness frameworks assess technical debt, integration complexity, change management capacity, and regulatory compliance before pilot initiation, achieving 4.5x higher production success rates than traditional proof-of-concept approaches

- The DIVAAA framework's Validate and Adopt stages require passing critical deployment readiness criteria. Successful venture-client partnerships evaluate API compatibility, data governance alignment, security protocols, legacy system integration, user training requirements, and operational workflows, with InsurTech and FinTech solutions requiring additional regulatory sandboxing that extends timelines by 30% but improves adoption by 250%

- CTO and CIO alignment on deployment readiness increases venture-client success rates to 82% from industry average of 15%. Organizations implementing joint technical-business readiness assessments achieve production deployment in 6-9 months versus 24-36 months for siloed innovation labs, with venture-client models providing $2-5M cost savings by identifying integration blockers before pilot investment

The Venture Client Model (VCM) has emerged as a powerful approach for large corporations to drive innovation by engaging with startups as early customers rather than equity investors. This model enables corporations to access cutting-edge technologies, accelerate innovation cycles, and foster mutually beneficial relationships with startups. As Fortune 500 corporations increasingly explore this model, it becomes crucial to assess their readiness and maturity in implementing and scaling the Venture Client approach.

This comprehensive Venture Client Model Readiness Assessment (VCM-RA), powered by Agolix, provides corporations of all sizes with a structured framework to evaluate their current capabilities, identify areas for improvement, and chart a path towards optimal VCM implementation. The assessment covers key dimensions critical to VCM success, including strategic alignment, leadership support, organizational structure, processes, culture, and performance measurement.

By completing this assessment, corporations can:

- Gain a clear understanding of their current VCM maturity level

- Identify strengths and areas for improvement in their VCM approach

- Benchmark their performance against industry best practices

- Develop targeted strategies to enhance their VCM capabilities

- Track progress over time as they evolve their VCM initiatives

The assessment utilizes a user-friendly scoring mechanism and provides actionable insights to guide corporations in their journey towards VCM excellence.

Introduction to the Venture Client Model

As previously shared, the Venture Client Model is a corporate innovation strategy where established companies engage with startups as early clients, purchasing and testing their innovative solutions without taking equity. This model, pioneered by Gregory Gimmy at BMW in 2014, has gained significant traction as a low-risk, high-impact approach to fostering innovation and addressing corporate challenges.

Key features of the Venture Client Model include:

- Low-risk engagement: Corporations can test startup solutions without long-term financial commitments.

- Accelerated innovation: Startups gain market validation and revenue, while corporations access cutting-edge technologies.

- Structured processes: The model typically involves phases such as problem identification, startup scouting, pilot testing, and integration.

The VCM offers several advantages over traditional corporate venturing approaches:

- Faster time-to-market: By directly integrating startup solutions, corporations can bring innovations to market more quickly.

- Reduced risk: The model allows for testing multiple solutions with minimal upfront investment.

- Cultural transformation: Engaging with startups can help foster a more innovative and agile corporate culture.

- Ecosystem development: The VCM contributes to building a robust innovation ecosystem around the corporation.

As corporations consider implementing or scaling their Venture Client initiatives, it becomes crucial to assess their readiness and maturity in this approach. The assessment below provides a comprehensive framework for evaluating VCM capabilities and charting a path towards excellence.

Assessment Framework

The Venture Client Model Readiness Assessment (VCM-RA) is structured around six key dimensions that are critical for successful VCM implementation:

- Strategy and Leadership

- Organizational Structure and Resources

- Processes and Tools

- Culture and Mindset

- Ecosystem and Partnerships

- Performance Measurement and Learning

Each dimension is further divided into specific criteria that are evaluated on a scale of 1 to 5, representing increasing levels of maturity:

- Initial: Basic awareness or ad-hoc implementation

- Developing: Early stages of structured implementation

- Defined: Clear processes and structures in place

- Managed: Systematic approach with continuous improvement

- Optimized: Best-in-class implementation with innovative practices

Assessment Dimensions and Criteria

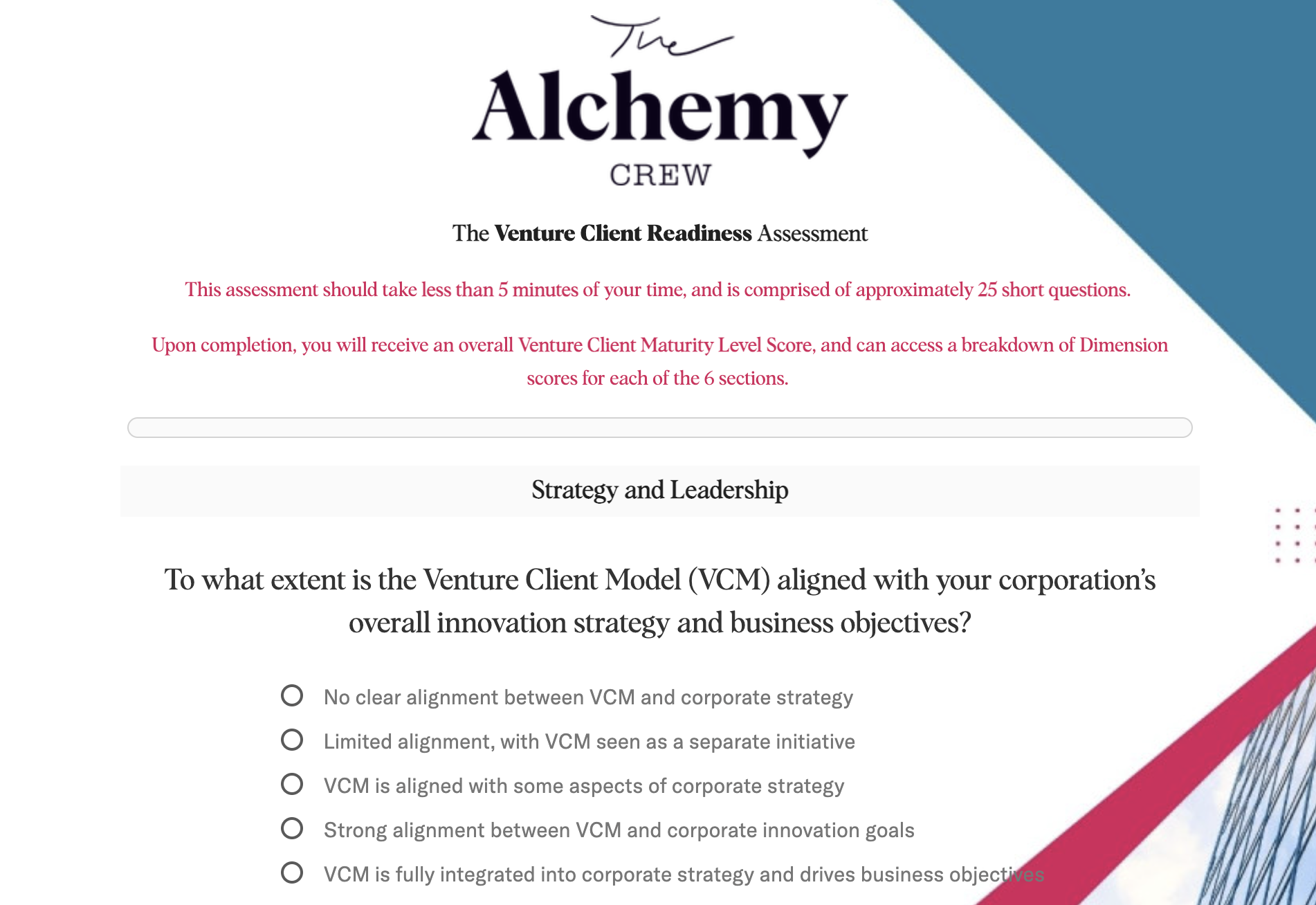

1 Strategy and Leadership

1.1 Strategic Alignment

To what extent is the Venture Client Model aligned with your corporation's overall innovation strategy and business objectives?

- No clear alignment between VCM and corporate strategy

- Limited alignment, with VCM seen as a separate initiative

- VCM is aligned with some aspects of corporate strategy

- Strong alignment between VCM and corporate innovation goals

- VCM is fully integrated into corporate strategy and drives business objectives

1.2 Leadership Commitment

How committed is your senior leadership to the implementation and success of the Venture Client Model?

- Limited awareness or support from senior leadership

- Some interest from leadership, but no active involvement

- Leadership supports VCM with occasional involvement

- Strong leadership support with regular engagement

- Full commitment from C-suite, with VCM as a top strategic priority

1.3 Vision and Goals

How clearly defined are the vision and goals for your Venture Client initiatives?

- No specific vision or goals for VCM

- Vague or short-term goals exist

- Clear goals defined, but limited long-term vision

- Well-defined vision and goals aligned with corporate strategy

- Comprehensive, long-term vision with clear milestones and success criteria

1.4 Resource Allocation

How effectively are resources (financial, human, technological) allocated to support Venture Client initiatives?

- Minimal or ad-hoc resource allocation

- Some resources allocated, but insufficient for full implementation

- Adequate resources allocated, but not optimally distributed

- Significant resources allocated with clear budgeting process

- Strategic resource allocation fully supporting VCM scaling and innovation

2 Organizational Structure and Resources

2.1 Dedicated Venture Client Unit

To what extent does your organization have a dedicated team or unit for managing Venture Client activities?

- No dedicated team or resources for VCM

- Informal team with part-time responsibilities

- Small dedicated team, but limited in scope or authority

- Well-established Venture Client Unit with clear mandate

- Fully empowered VCLU with cross-functional representation and executive support

2.2 Roles and Responsibilities

How clearly defined are the roles and responsibilities for Venture Client activities within your organization?

- No defined roles for VCM activities

- Some roles defined, but with significant overlap or gaps

- Clear roles defined for core VCM activities

- Comprehensive role definitions across the organization

- Roles and responsibilities optimized for maximum efficiency and impact

2.3 Skills and Expertise

To what extent does your organization have the necessary skills and expertise to effectively implement the Venture Client Model?

- Limited relevant skills or expertise in-house

- Some relevant skills, but significant gaps exist

- Core skills present, with ongoing efforts to build expertise

- Strong skill set with specialized expertise in key areas

- World-class expertise with continuous skill development and knowledge sharing

2.4 Cross-functional Collaboration

How effectively do different departments and functions collaborate in support of Venture Client initiatives?

- Minimal cross-functional collaboration

- Some collaboration, but often siloed or ineffective

- Regular collaboration between key functions

- Strong cross-functional teams with clear communication channels

- Seamless collaboration across the organization, fostering innovation and knowledge sharing

3 Processes and Tools

3.1 Problem Identification

How systematic is your approach to identifying and prioritizing business challenges suitable for Venture Client solutions?

- Ad-hoc or reactive problem identification

- Basic process for identifying problems, but not systematic

- Structured process for problem identification and prioritization

- Comprehensive approach integrating multiple stakeholders and data sources

- Advanced, data-driven problem identification with predictive capabilities

3.2 Startup Scouting and Selection

How effective is your process for scouting, evaluating, and selecting startups for potential collaboration?

- No formal scouting or selection process

- Basic scouting process with limited evaluation criteria

- Structured scouting and selection process with defined criteria

- Comprehensive process leveraging multiple channels and advanced evaluation techniques

- AI-driven scouting and selection process with continuous optimization

3.3 Pilot Project Management

How well-defined and efficient is your process for managing pilot projects with startups?

- No standardized approach to pilot projects

- Basic pilot project guidelines exist

- Structured pilot process with clear stages and decision points

- Comprehensive pilot management framework with risk mitigation strategies

- Agile, data-driven pilot process with real-time adjustments and learning capture

3.4 Integration and Scaling

How effective is your approach to integrating successful pilot projects and scaling them across the organization?

- No clear path for integration or scaling

- Ad-hoc integration with limited scaling

- Defined process for integration, but scaling challenges remain

- Systematic approach to integration and scaling with clear success metrics

- Seamless integration and scaling process with proactive identification of scaling opportunities

3.5 Technology and Tools

To what extent do you leverage technology and specialized tools to support Venture Client activities?

- Minimal use of technology or specialized tools

- Basic tools used, but not integrated or optimized

- Dedicated tools for core VCM activities

- Integrated suite of tools supporting end-to-end VCM process

- Advanced, AI-driven platform optimizing all aspects of VCM implementation

4 Culture and Mindset

4.1 Innovation Culture

How supportive is your organizational culture of innovation and collaboration with startups?

- Risk-averse culture with resistance to external innovation

- Some pockets of innovation culture, but not widespread

- Generally supportive culture with growing openness to startups

- Strong innovation culture embracing startup collaboration

- Pervasive culture of innovation driving proactive engagement with startups

4.2 Risk Tolerance

To what extent does your organization tolerate and learn from failure in innovation initiatives?

- Low risk tolerance with a punitive approach to failure

- Some acceptance of risk, but failure often stigmatized

- Growing risk tolerance with efforts to learn from failures

- High risk tolerance with a structured approach to learning from failures

- Failure viewed as a valuable learning opportunity, driving continuous improvement

4.3 Agility and Adaptability

How agile and adaptable is your organization in responding to new opportunities and challenges in the startup ecosystem?

- Rigid processes with slow response to change

- Some flexibility, but significant barriers to rapid adaptation

- Growing agility with efforts to streamline decision-making

- High degree of agility in core VCM activities

- Organizational agility as a core competency, enabling rapid pivots and experimentation

4.4 Internal Communication

How effective is your internal communication about Venture Client initiatives and their impact?

- Minimal communication about VCM activities

- Some communication, but limited in reach or effectiveness

- Regular communication through established channels

- Comprehensive communication strategy with multiple touchpoints

- Pervasive, multi-channel communication fostering widespread engagement and enthusiasm

5 Ecosystem and Partnerships

5.1 Startup Ecosystem Engagement

How actively does your organization engage with the broader startup ecosystem?

- Minimal engagement with startup ecosystem

- Some engagement, but limited in scope or consistency

- Regular engagement through established channels

- Active participation in multiple ecosystem activities and events

- Leadership role in shaping and nurturing the startup ecosystem

5.2 Partnership Network

How extensive and diverse is your network of partners supporting Venture Client activities?

- Few or no formal partnerships

- Limited partnerships, primarily with traditional vendors

- Growing network of diverse partners

- Extensive partnership network covering multiple domains

- Strategic, mutually beneficial partnerships driving innovation and value creation

5.3 Co-creation and Open Innovation

To what extent does your organization engage in co-creation and open innovation initiatives with startups and other partners?

- Minimal co-creation or open innovation activities

- Some co-creation efforts, but limited in scope

- Regular co-creation initiatives with selected partners

- Extensive co-creation program with diverse participants

- Open innovation as a core strategy, driving significant value creation

5.4 Industry Collaboration

How effectively does your organization collaborate with industry peers and competitors on innovation initiatives?

- Minimal collaboration with industry peers

- Some collaboration, but limited to non-competitive areas

- Growing collaboration with clear boundaries

- Active collaboration on key industry challenges

- Leadership in driving industry-wide innovation initiatives

6 Performance Measurement and Learning

6.1 KPI Definition and Tracking

How well-defined and comprehensive are your Key Performance Indicators (KPIs) for Venture Client activities?

- No specific KPIs for VCM activities

- Basic KPIs defined, but not consistently tracked

- Clear KPIs covering core VCM activities

- Comprehensive set of KPIs balancing short-term and long-term impact

- Advanced, multi-dimensional KPI framework driving continuous optimization

6.2 Impact Assessment

How effectively do you measure and communicate the impact of Venture Client initiatives on your organization?

- Minimal assessment of VCM impact

- Basic impact assessment, primarily focused on financial metrics

- Regular impact assessment covering multiple dimensions

- Comprehensive impact assessment with clear link to corporate objectives

- Sophisticated impact modeling with predictive capabilities

6.3 Learning and Knowledge Management

How systematic is your approach to capturing, sharing, and applying learnings from Venture Client activities?

- No formal learning or knowledge management process

- Ad-hoc learning capture with limited sharing

- Structured process for capturing and sharing key learnings

- Comprehensive knowledge management system with active participation

- AI-driven knowledge management fostering continuous learning and innovation

6.4 Continuous Improvement

To what extent does your organization continuously improve its Venture Client approach based on learnings and feedback?

- Minimal efforts to improve VCM approach

- Some improvements, but reactive and inconsistent

- Regular review and improvement of core VCM processes

- Systematic approach to continuous improvement across all aspects of VCM

- Culture of relentless improvement driving ongoing VCM innovation

Scoring Mechanism

The Venture Client Model Readiness Assessment uses a straightforward scoring mechanism to provide corporations with a clear understanding of their current maturity level and areas for improvement.

Individual Criteria Scoring

Each criterion is scored on a scale of 1 to 5, as described in the assessment framework:

- Initial: Basic awareness or ad-hoc implementation

- Developing: Early stages of structured implementation

- Defined: Clear processes and structures in place

- Managed: Systematic approach with continuous improvement

- Optimized: Best-in-class implementation with innovative practices

Dimension Scoring

The score for each dimension is calculated as the average of its constituent criteria scores, rounded to one decimal place. This provides a nuanced view of performance within each key area of VCM implementation.

Overall Maturity Score

The overall Venture Client Model Maturity Score is calculated as the average of all dimension scores, rounded to one decimal place. This score provides a high-level indication of the corporation's overall readiness and maturity in implementing the Venture Client Model.

Maturity Levels

Based on the overall maturity score, corporations are classified into one of five maturity levels:

- Novice (Score 1.0 - 1.9): Early stages of VCM awareness and implementation

- Emerging (Score 2.0 - 2.9): Growing VCM capabilities with some structured approaches

- Established (Score 3.0 - 3.9): Well-defined VCM processes with consistent implementation

- Advanced (Score 4.0 - 4.9): Sophisticated VCM approach with proactive optimization

- Visionary (Score 5.0): Best-in-class VCM implementation driving industry leadership

Take the Test Here

Want to know more? Contact us here.

Interpreting Results and Next Steps

Upon completing the assessment, corporations will receive a detailed report of their results, including:

- Overall Venture Client Model Maturity Score and corresponding maturity level

- Scores for each of the six dimensions

- Detailed breakdown of scores for individual criteria

- Visualizations of results

Strengths and Areas for Improvement

The report will highlight key strengths and areas for improvement based on your assessment results. This analysis will provide actionable insights for enhancing VCM capabilities.

Recommended Actions

Based on the assessment results, the report will offer tailored recommendations for improving VCM maturity. These recommendations will be prioritized based on their potential impact and alignment with the corporation's strategic objectives.

Roadmap Development

To support ongoing improvement, the report will include guidance on developing a roadmap for enhancing VCM capabilities. This roadmap will outline key milestones, resource requirements, and timelines for implementation.

Continuous Assessment

Corporations are encouraged to retake the assessment periodically (e.g., annually) to track progress and identify new areas for improvement. This continuous assessment approach supports the ongoing evolution and optimization of VCM initiatives.

Case Studies

To provide context and inspiration, this article includes brief case studies of Fortune 500 corporations that have successfully implemented and scaled their Venture Client initiatives. These case studies highlight best practices, key success factors, and lessons learned. These projects come from market research.

BMW Startup Garage

BMW's venture client unit, established in 2015, has been a pioneer in implementing and refining the venture client model.

Key Achievements:

- Over 50 startups have successfully completed the program, with many continuing to contribute cutting-edge technologies to BMW.

- The unit has reduced the time required to establish partnerships with startups from over two years to just a few months.

- Notable success stories include partnerships with Lunewave for revolutionary sensor technology and QC Ware for quantum computing applications.

Lessons Learned:

- The importance of a structured onboarding process for startups, including developing functional prototypes relevant to BMW's needs.

- The value of a multi-pillar support framework (Build, Sell, Learn, and Network) in ensuring successful collaborations.

- The critical role of transparent communication and regular feedback sessions in aligning startup solutions with automotive industry requirements.

Siemens Energy Ventures

Siemens Energy Ventures has demonstrated the effectiveness of the venture client model in the energy sector.

Key Achievements:

- The unit has overseen over 78 pilot projects.

- 40% of pilot projects have resulted in technology adoption or extended partnerships.

- The unit has generated approximately $80 million in financial impact.

Lessons Learned:

- The importance of clear problem definition in the startup scouting process.

- The value of embedding venture managers within business units to facilitate communication and alignment.

- The effectiveness of pilot projects with defined metrics in measuring progress and adjusting expectations.

Bosch Open Innovation Unit

Bosch's Open Innovation unit has leveraged the venture client model to drive significant cost savings and operational improvements.

Key Achievements:

- The unit reported multi-million Euro savings achieved through improved inspection accuracy.

- Successfully integrated new technologies to enhance internal processes.

- Developed partnerships with startups like Teralytics to optimize traffic management systems.

Lessons Learned:

- The importance of rigorous scouting and benchmarking processes in identifying high-potential startups.

- The value of transparent communication channels in keeping both parties informed and aligned.

- The effectiveness of focusing on measurable outcomes, such as cost savings and efficiency improvements, in demonstrating value to stakeholders.

Take The Assessment...

The Venture Client Model Readiness Assessment provides corporations with a comprehensive framework for evaluating their capabilities and charting a path towards VCM excellence. By systematically assessing key dimensions of VCM implementation, corporations can identify strengths, address weaknesses, and develop targeted strategies for improvement.

As the business landscape continues to evolve, the ability to effectively collaborate with startups and integrate cutting-edge innovations will become increasingly critical for maintaining competitive advantage. The Venture Client Model offers a powerful approach for achieving this goal, and this assessment serves as a valuable tool for corporations seeking to optimize their VCM initiatives.

By leveraging the insights gained from this assessment, corporations can enhance their innovation capabilities, accelerate time-to-market for new solutions, and foster a culture of continuous improvement and collaboration. Ultimately, mastering the Venture Client Model can position corporations as industry leaders, driving growth and creating lasting value in an increasingly global marketplace.

Want to know more? Contact us here.