The Real Crisis in Insurance Isn’t Capital. It’s Capacity! (Find Out Why...)

Feb 11, 2026

Written by Sabine VanderLinden

-

The insurance industry is facing a quiet crisis, not of capital, but of capacity or the ability to execute on its ambitious transformation goals. Understanding the broader context in which insurance risk is assessed, especially for emerging risks like cyber and climate, is critical to addressing this challenge.

-

Systemic risks like climate change, cyber threats, and AI are creating uninsurable realities, while the organization’s operational and human infrastructure struggles to keep pace.

-

Closing this “capacity gap” requires a fundamental shift from admiring the problem to building new execution pathways through public-private collaboration, regulatory innovation, and strategic partnerships with frontier firms, efforts all aligned with the organization’s strategic objectives.

Let’s start with a truth every insurance executive knows but rarely says out loud: your biggest problem isn’t a lack of capital. It’s a lack of capacity. Imagine a world where vast stretches of California are uninsurable against wildfires, where a single cyberattack on a public utility creates a cascade of uninsured systemic failures, and where the very AI designed to save us generates liabilities so complex they defy traditional underwriting. This is the world we are building, one ignored capacity constraint at a time.

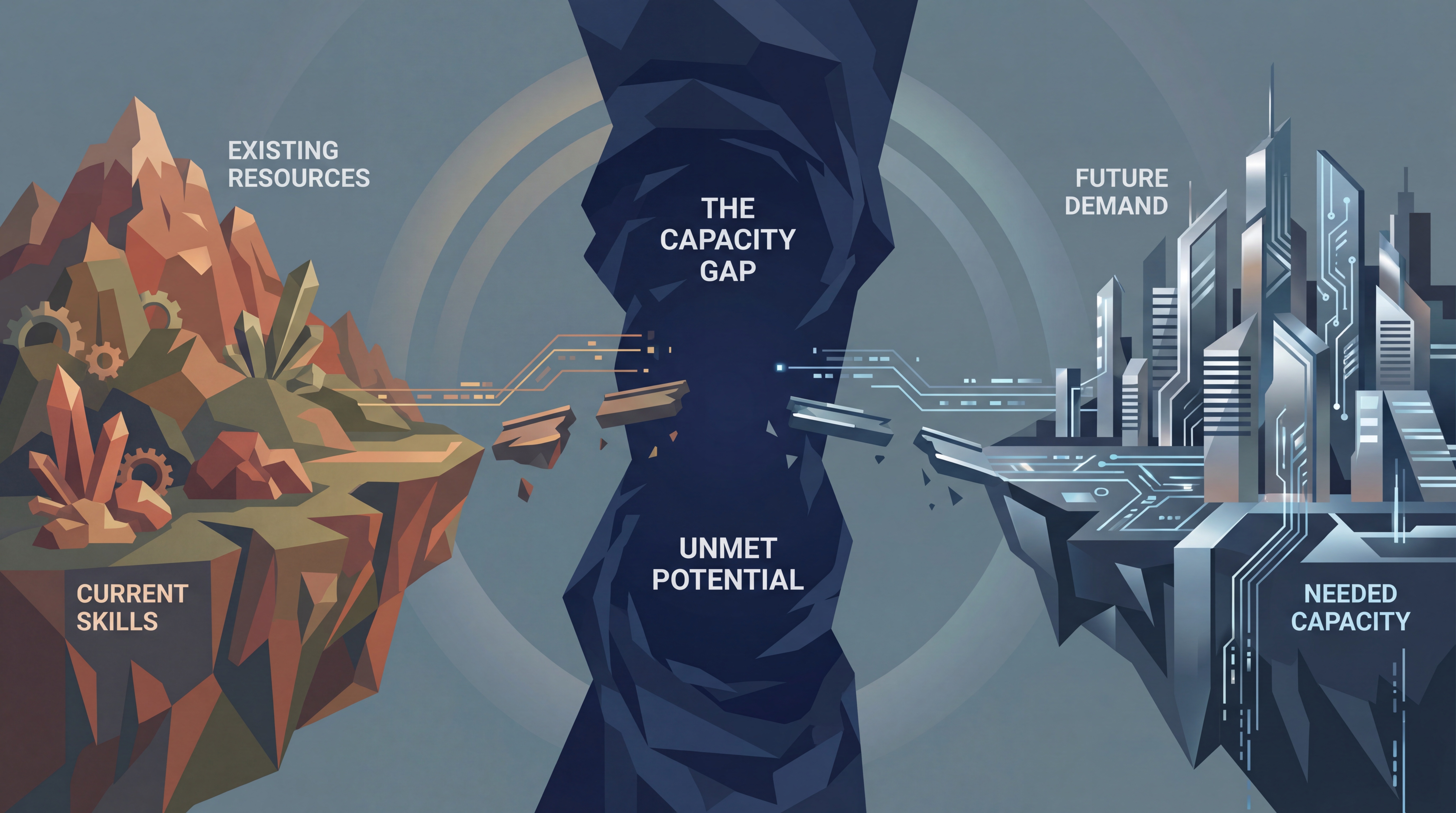

The insurance industry is standing at a precipice. On one side lies the ambition of a digitally transformed, AI-powered future. On the other side, the stark reality of an operating model struggling under the weight of its own legacy. The chasm between them is the Capacity Gap, and it’s where even the most brilliant strategies go to die. For years, we’ve admired this problem from a safe distance. Now, it’s time to build the bridges to cross it.

What the Capacity Gap Really Is

The capacity gap is the critical disconnect between an organization’s strategic ambitions and its actual ability to deliver. It’s a math problem, not a people problem. It’s the finite resources of talent, technology, and operational throughput clashing with the infinite demands of digital transformation, regulatory pressure, and escalating market risks. This is the current execution crisis playing out in real-time. Effective risk management enables organizations to make better decisions even amid uncertainty, allowing them to anticipate, assess, and respond to risks proactively rather than simply react to challenges.

Consider the data: while the insurance industry is flush with capital, the success rate of digital transformation projects remains below 30% [1]. A staggering two-thirds of insurance companies still run on outdated legacy technology, and up to 70% of their annual IT budget is consumed by maintaining these aging systems [2]. This leaves precious little bandwidth for the innovation required to compete. Advanced data capabilities are now essential to identify risks and potential system failures in real time, from cyber threats to weather-related hazards. The gap manifests as a vicious cycle: ambition leads to new projects, projects overload the system, and the system, constrained by its own legacy, fails to deliver, leading to a graveyard of perpetual pilots and abandoned transformations.

When capacity is stretched, the possibility of adverse outcomes and project failures increases significantly. One study found that 61% of digital projects were canceled simply because the application couldn’t access the right data, a direct symptom of a system at war with itself [1]. In such a volatile environment, it is increasingly difficult to predict which digital transformation projects will succeed, making adaptability and resilience more critical than ever.

Why Capital Alone Won’t Save Us

The industry often defaults to a capital-centric view of risk, but this is a dangerous oversimplification. The global reinsurance market is robust, with capital expanding to $720 billion in early 2025 [3]. The US retirement market alone holds approximately $36 trillion in assets [4]. The money is there. The problem is that no amount of capital can write a policy for a risk that is fundamentally uninsurable due to its scale, complexity, or unpredictability. Capacity in insurance is defined as the maximum amount of risk or premium volume an insurer is willing to underwrite.

We are witnessing the emergence of “actuarial black holes” in which risk cannot be modeled or priced effectively. In 2025, natural disasters caused $224 billion in global losses, with only $108 billion insured, leaving a protection gap of over 50% [5]. This isn’t a failure of capital. This is a failure of capacity to absorb and manage risk at this new scale. Insurers are already retreating from high-risk areas in states like California and Florida, not because they lack the money, but because they lack the models, infrastructure, and regulatory frameworks to operate sustainably. The capacity crisis is leading insurers to exit high-risk areas, such as flood-prone properties and certain motor lines. Capital is a necessary condition for a functioning insurance market, but it is no longer sufficient. Capacity is the new capital.

The catastrophe bond market, which posted record issuance of over $16.8 billion in the first half of 2025 alone, demonstrates that alternative capital is abundant and eager to participate in risk markets [3]. Yet this capital sits idle when the underlying risks cannot be accurately modeled, priced, or managed. There is a rise in Alternative Risk Transfer mechanisms, such as captives and parametric insurance, as traditional insurers withdraw. The bottleneck is not financial. It is operational and intellectual. Reinsurers are restricting coverage, creating a supply problem at the primary insurer level during the market hardening cycle. We have the money to insure the future, but we lack the systems, the talent, and the frameworks to do so responsibly.

This capacity crisis is driving a long-term transformation in the insurance industry toward a more strategic and costly approach to risk management.

The Human Limits of Risk Absorption

Beyond technology and capital, the capacity gap is profoundly human. The US insurance industry, as an organization, must adapt to new realities by structurally integrating technology, data, and personnel to enhance operational efficiency, innovation, and risk management. The industry is facing a demographic cliff, projected to lose around 400,000 workers by 2026 to retirement and attrition [6]. This exodus of institutional knowledge is happening just as the demand for new skills is exploding. Over half of all insurance providers are actively recruiting for data analytics talent, a skill set that is in notoriously short supply [6].

This isn’t just about hiring data scientists. It’s about a fundamental mismatch between the skills the organization has and the skills it needs to navigate a future of AI, cyber threats, and complex systemic risks. Insurers must reinvent themselves by focusing intently on the customer to cope with disruption.

Companies that effectively cope with disruption will focus on customer-centric business models. Insurers are increasingly focusing on customer-centric approaches to address the complexities of emerging risks. Employees who perceive a bright future at their company are 1.7 times more likely to stay, 2.3 times more engaged, and 2.4 times more likely to recommend their company to others [7]. Yet too often, the industry’s legacy culture and technology stack send the opposite signal to the very talent it needs to attract. The result is a workforce stretched to its breaking point, where burnout is disguised as resilience and innovation is suffocated by the daily struggle to keep legacy systems running. As one analyst noted, while technology can ease administrative burdens, it increases the need for critical thinking and complex problem-solving, the very skills that are hardest to scale and are walking out the door [7].

The future of insurance will depend on the ability to quickly configure for innovation and lower costs.

The Role of Risk Pooling

Risk pooling stands as one of the most powerful tools in the insurance and financial services arsenal for managing the risks inherent in today’s volatile environment. At its core, risk pooling is the process of combining risks from multiple sources—companies, individuals, or asset classes—to reduce each participant's overall risk exposure. This collective approach not only increases financial stability but also enhances the industry’s capacity to absorb shocks from events such as cyberattacks, natural disasters, or supply chain disruptions.

The effectiveness of risk pooling hinges on several key factors.

Advanced data analytics and modeling techniques are now essential for identifying, assessing, and predicting the likelihood and extent of potential losses. By leveraging these tools, insurers and institutional investors can better understand the nature of the risks they face, diversify their exposure, and develop strategies to mitigate or transfer risk. For example, when companies in the same sector pool their risks, they collectively reduce their vulnerability to uncertainty and potential loss, enabling each to benefit from broader coverage at a lower cost.

Institutional investors—including pension funds and hedge funds—have increasingly relied on risk pooling to manage exposure across diverse asset classes and global supply chains. This approach not only protects their portfolios from isolated shocks but also provides a sense of security in the face of complex, interconnected threats. The rise of risk pooling is a direct response to the growing need for organizations to manage risk exposure more effectively, especially as the frequency and severity of systemic risks continue to climb.

The process of risk pooling is both art and science.

It begins with a thorough risk assessment: identifying relevant risks, determining the extent of the exposure, and using data analytics to model potential outcomes. From there, organizations develop measures to mitigate, transfer, or absorb risk, often through tailored insurance products or collaborative industry pools. The result is a more resilient system: one with greater capacity to withstand unexpected events and uncertainties.

The benefits of risk pooling extend beyond insurers and investors.

Employers and employees gain protection against unforeseen circumstances, while society and government benefit from increased financial stability and reduced costs associated with managing large-scale risks. Retirement and government pension plans, for instance, use risk pooling to ensure long-term security for beneficiaries, even amid demographic shifts and market volatility.

However, risk pooling is not without its limitations. Effective management requires skilled professionals who can navigate the complexities of risk modeling and data analysis. There is also the potential for moral hazard, where participants may take on greater risks knowing they are protected by the pool. Despite these challenges, research consistently shows that risk pooling remains a cornerstone strategy for managing uncertainty and protecting against potential harm.

As the insurance industry and its partners confront an era defined by systemic threats and rapid change, the value of risk pooling will only continue to rise. Organizations that are aware of both the benefits and limitations—and who invest in the right systems, skills, and data—will be best positioned to manage their risk exposure, protect their clients, and deliver on the promise of resilience in an uncertain future.

Where Capacity Is Breaking First

The capacity gap is not a distant threat; it is a clear and present danger, most visible at the frontiers of risk.

|

Risk Frontier |

The Capacity Breakdown |

Key Statistic |

|

Insurers are withdrawing from high-risk zones as natural catastrophe losses become unmanageable. The protection gap for natural disasters in 2024 stood at $181 billion. |

57% of global economic losses from natural catastrophes are uninsured [8]. |

|

|

Cyber Risk |

The systemic nature of cyber threats is forcing insurers to limit coverage. Lloyd’s now mandates exclusions for state-backed cyberattacks, creating significant coverage gaps. |

The FBI reported $16.6 billion in cybercrime losses in 2024, a figure it admits is artificially low [9]. |

|

AI Risk |

While 76% of US insurers are implementing AI, only 45% believe the benefits outweigh the risks, highlighting a massive gap in governance and execution capacity [10]. |

AI leaders in insurance generate 6.1x the shareholder return of laggards, proving the cost of inaction [11]. |

|

Longevity Risk |

With 11,200 Americans turning 65 daily, the industry faces immense pressure to manage decumulation and long-term care needs, shifting to hybrid products as old models fail [4]. |

The US population aged 80+ is projected to more than double by 2050 [8]. |

How We Rebuild Capacity — Not Just Transfer Risk

Closing the capacity gap requires a radical shift in mindset and operating models. It’s not about finding clever new ways to transfer risk; it’s about building the collective capacity to reduce, manage, and prevent it. This is a challenge that no single company can solve alone. It demands a new architecture of public-private collaboration that enables organizations and communities to respond effectively to risks and disruptions.

- First, we must industrialize innovation through new partnership models. The venture-client model, where corporations become clients of startups rather than just investors, offers a powerful pathway. It allows insurers to procure cutting-edge capabilities—from AI-driven underwriting to climate risk analytics—as a service, directly closing internal skill and technology gaps. This is not about outsourcing innovation. It’s about insourcing capacity. Insurers must also leverage data analytics and digital channels to differentiate themselves in a competitive market, and are increasingly using technology to proactively notify policyholders of risks and potential claims.

- Second, we must champion regulatory innovation. The rise of regulatory sandboxes in at least 13 US states is a promising start, creating controlled environments for testing new products and business models [12]. Regulators and standard-setting bodies have a crucial role to play, not as gatekeepers, but as architects of a more resilient and adaptive market. Managing the risks inherent in compliance is just as important as managing any other risk. The NAIC’s model bulletin on AI is a step in the right direction, but we need to move faster to create clear, consistent frameworks that encourage responsible innovation while ensuring market stability [13]. The goals of a compliance-focused team can also become misaligned with the organization's wider goals, leading to poor decisions.

- Third, we must build a cross-sector risk infrastructure. The most significant risks we face—climate change, pandemics, systemic cyber failure—are interconnected and transcend industry boundaries. Addressing them requires shared data platforms, collaborative response protocols, and new financial instruments co-created by insurers, governments, and frontier technology firms. Effective communication strategies are vital for managing risks and enhancing resilience in the insurance sector. Communication between those who analyze risks and those who make decisions based on that analysis must be clear, understandable, and useful. Risk communication strategies involve sharing and understanding uncertainties to empower informed decisions for well-being and a sustainable future. This is the ultimate expression of closing the capacity gap: building a resilient ecosystem that is greater than the sum of its parts.

The purpose of risk management is to enable us to make the best possible decisions based on our analysis of future events and outcomes. The choice before the insurance industry is stark: continue patching the cracks in a crumbling foundation, or lead the charge to design a new one. The real crisis isn’t a lack of capital. It’s a lack of execution capacity. The real opportunity is to build it together.

Frontier firms have already demonstrated what is possible. Companies that treat capacity as a strategic asset, investing in modular tech stacks, strong partner ecosystems, and embedded innovation pipelines, are pulling ahead. They don’t ask how to build everything internally. They ask how to close the gap intelligently. The insurance industry must adopt this same mindset.

The question is no longer whether we can afford to close the capacity gap. The question is whether we can afford not to. Who will lead the charge in building the risk infrastructure of the future?

The answer will define the next era of our industry.

Frequently Asked Questions (FAQ)

1. What is the “Capacity Gap” in insurance?

The Capacity Gap is the growing divide between the insurance industry’s strategic goals (such as digital transformation and managing new risks) and its ability to execute them, due to limitations in talent, technology, and operational processes.

2. Why is more capital not the solution to this problem?

Capital can’t solve for risks that are becoming fundamentally uninsurable due to their scale and complexity, such as widespread climate events or systemic cyberattacks. The problem is a lack of execution and risk absorption capacity, not a shortage of money.

3. How can insurers start to close this gap?

Insurers can begin by embracing new partnership models like venture-clienting to rapidly acquire new capabilities, advocating for and participating in regulatory sandboxes to accelerate innovation, and collaborating with public and private sector partners to build shared infrastructure for managing systemic risks.

References

[1] Insurance Thought Leadership, “4 Reasons Digital Transformations Are Failing”

[2] Earnix, “Overcoming Legacy Technology: The Future of Insurance Innovation”

[3] Aon, “Reinsurance Market Dynamics - July 2025 Report”

[4] McKinsey, “The US retirement industry at a crossroads”

[5] Munich Re, “Natural disaster figures for 2025”

[6] Insurance Business Magazine, “US insurance sector to lose around 400,000 workers by 2026”

[7] PwC, “How can insurers win the war for talent?”

[8] Swiss Re Institute, “Sigma 4/2025: The life and health insurance industry in the new risk landscape”

[9] FBI Internet Crime Complaint Center (IC3), “2024 Internet Crime Report”

[10] Deloitte, “Scaling generative AI in the US insurance industry”

[11] McKinsey, “The future of AI for the insurance industry”

[12] National Conference of State Legislatures, “Regulatory Sandbox Trends 2024”

[13] Understanding NAIC “Model Bulletin on the Use of Artificial Intelligence Systems by Insurers”