The Agentic Frontier: Why Your Next Competitor Isn't a Company—It's an AI

Jan 11, 2026

Written by Sabine VanderLinden

-

Unlock the "Agentic AI" Advantage: Discover what it means to be an Agentic Frontier Firm in insurance—an AI-native, autonomous insurer built around intelligent agents, not just algorithms.

-

From Copilot to Autonomous Operations: See how generative AI copilots are evolving into fully autonomous insurance operations, and why a true AI-native core platform is the only way to scale this revolution. Explore how AI will transform the insurance landscape by 2030.

-

Future-proof with Humans-in-the-Loop: Learn how leading insurers marry agentic AI with human oversight to transform workflows, slash expense ratios, and stay compliant in a heavily regulated industry.

Is Your Company Up For This?

Imagine an insurance company that never sleeps. What if, at 2:00 AM, an AI agent in your core system is already underwriting a new policy quote—pulling data, applying rules, and drafting documents—all before any employee clocks in? By the time your underwriter starts the day, 80% of the work is done. What if routine claims could be acknowledged and triaged within minutes by autonomous AI, giving customers near-instant reassurance?

This is the dawning reality of the Agentic Frontier Firm in insurance. Agentic AI sits at the intersection of artificial intelligence and advanced ai technologies, driving digital transformations that enable innovation, operational efficiency, and strategic change across the insurance sector. And those who embrace it now will define the next era of our industry, leaving the laggards in the dust.

A few weeks ago, Munich Re began underwriting the errors of AI models—essentially insuring the mistakes of a machine’s mind within the mortgage lending sector [1]. Let that sink in: we can now insure AI’s decisions. However, we are still in the early stages of adopting agentic AI, and integrating these systems requires significant expertise to ensure effective deployment and value creation. The agentic frontier firm has arrived, and with it comes a pivotal question: Will you watch from the sidelines, or will you help lead this AI-driven transformation?

This article is for insurance executives, technology leaders, and innovation strategists seeking to understand why the agentic frontier will impact every enterprise and why your next competitor isn't a company—it's likely to be an AI co-worker.

Agentic AI is a breakthrough capability that will become a competitive necessity for enterprises.

Why This Matters Now

The data is in, and it’s a wake-up call. While 78% of P&C insurers are “dabbling” with generative AI in the claims process, only 4% have scaled it enterprise-wide, and we can assume this is the same across the entire enterprise. Most are stuck in what experts call the “pilot trap”: many promising proofs of concept, very few fully deployed solutions. Bain & Company’s 2025 study found that nearly three in four insurers are still just experimenting, and only a tiny elite have rebuilt their processes around AI [2]. The result? A widening chasm between talkers and doers.

To close this gap, insurers are fundamentally rethinking their operating models, rewiring workflows and organizational structures to embed agentic AI at scale.

This gap will only grow. Those few “frontier” insurers are already seeing 35% productivity gains and 50% faster cycle times by reengineering key processes with AI [2]. They’ve proven that sprinkling AI on legacy systems is a dead end; the real ROI comes from rethinking the business around AI. For insurance leaders, the question is no longer if you’ll embrace agentic AI, but how fast you can scale it to avoid falling behind.

By 2026, an estimated 70% of organizations expect agentic AI to significantly disrupt existing business models.

What Is an Agentic Frontier Firm (in Insurance)?

In essence, an Agentic Frontier Firm is a company at the leading edge of productivity and innovation, characterized by its embrace of AI agents and autonomy as core to its operations. The term “frontier firm” originated in economics to describe the top 5–10% of companies in an industry that dramatically outperform the rest [3]. They aren’t necessarily the biggest or oldest players, but they are the smartest and fastest—constantly experimenting, adapting, and scaling what works. These firms leverage new tools and services, including agentic AI systems, support functions, and data-driven platforms, to enable, deploy, and manage AI across their workflows.

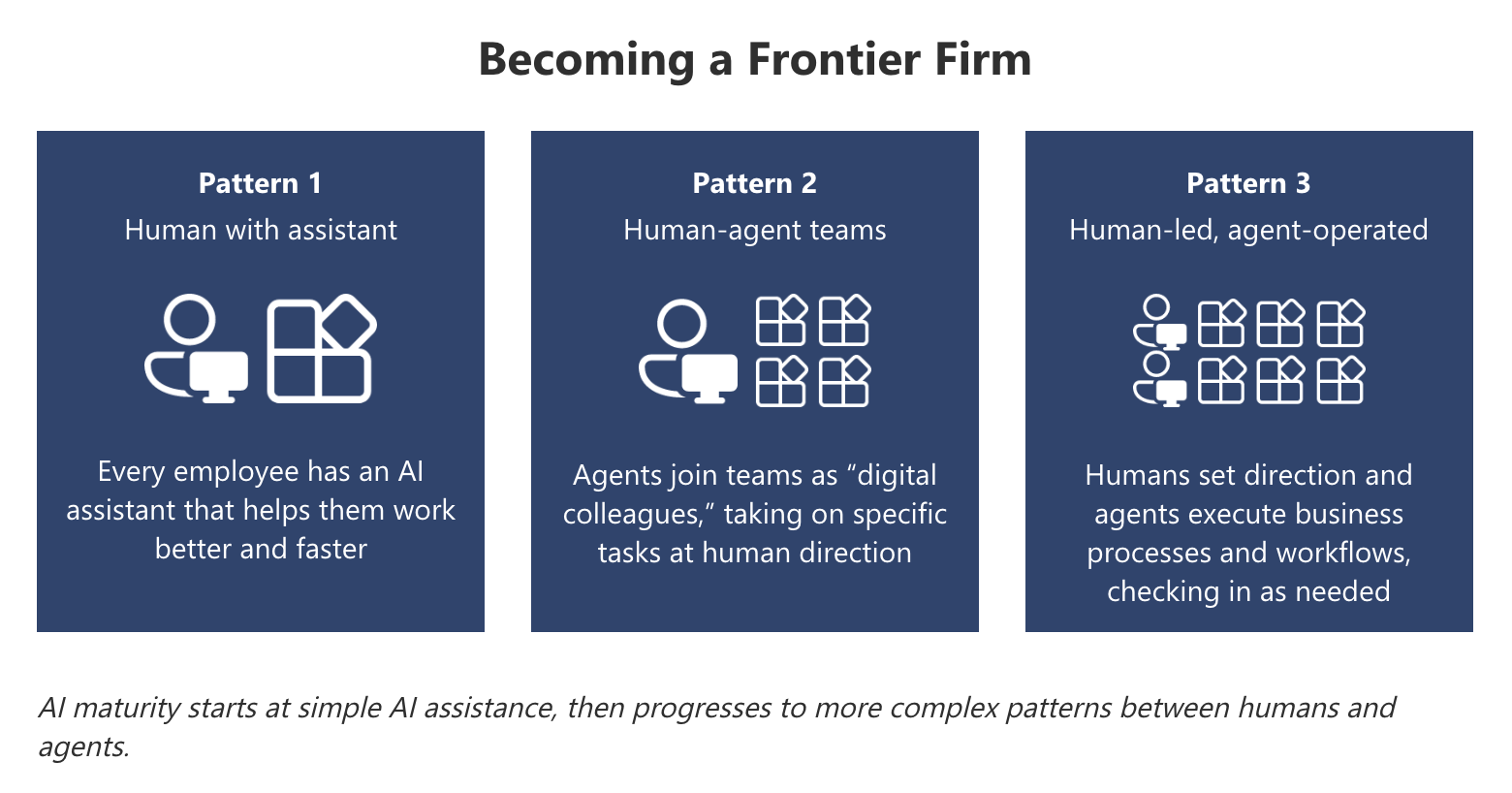

Microsoft’s recent Work Trend Index described it best: 2025 will go down as the year the Frontier Firm was born: the moment when companies moved beyond experimenting with AI and began rebuilding around it, pairing human insight with AI and agents to unlock outsize value [4].

source: Microsoft

So what makes a frontier firm agentic? The word comes from “agent” in AI; agents are autonomous software entities that can perceive, reason, and act to achieve goals. Agentic AI refers to AI that not only responds to prompts but also acts autonomously and proactively, within defined guardrails, to carry out tasks and make decisions. Put simply, it’s AI with a driver’s license, not just a passenger seat. In this new landscape, businesses are competing for Agent Optimisation (AIO) rather than just SEO in the answer economy.

"Agentic AI systems can plan, decide, and act autonomously, orchestrating complex workflows with minimal human intervention. Unlike traditional AI, agentic AI can gather inputs from its environment to plan, adapt, and execute tasks independently. Agentic AI is an advanced artificial intelligence system capable of autonomous decision-making and action."

An agentic frontier firm in insurance is a carrier or MGA with AI agents woven into its DNA, automating and optimizing processes across underwriting, claims, customer service, and beyond, while humans steer high-level strategy and oversight. Crucially, being agentic and AI-native is a mindset as much as a tech stack. It means the insurer leads with an AI-first strategy, embedding intelligence at every layer of the business [5].

The payoff? Frontier Firms are seeing outcomes three to four times better than those of slow adopters across metrics such as growth, efficiency, and customer experience [6].

From GenAI Copilots to Autonomous Insurance Operations

When generative AI burst onto the scene, many insurers started with copilots, AI assistants that help humans with tasks like drafting emails, summarizing documents, or answering questions. Early results were impressive: on average, 23% time savings on tasks, with 84% of users engaging daily [7]. One auto insurer saw quote processing time drop by 70%—from 10 minutes to 3—with AI guidance.

Yet, generative AI copilots remain fundamentally reactive. They wait for a human prompt. The agentic leap is about moving from AI assistance to AI autonomy. Instead of an underwriter having to ask the AI questions, what if the AI knew the underwriter’s goals and took initiative? Agentic AI enables self-directed decision-making, allowing systems to autonomously perceive data, reason, plan, and execute actions —including underwriting decisions—without human oversight, thereby enhancing operational efficiency and consistency.

This is where Agentic AI comes in. Agentic AI systems can act autonomously to achieve a goal within defined parameters and only notify a human when they need guidance or approval [8]. As one industry colleague quipped, it’s like going from using a calculator to using a self-driving car—it knows the destination and drives itself.

We are witnessing the shift from AI as a consultant to AI as a co-worker. In phase one, AI copilots were like smart interns sitting next to employees. In phase two, we’re entering the era of human-agent teams, where AI agents handle many tasks independently, and humans supervise. AI agents can now manage thousands of unique, context-aware, complex customer interactions simultaneously, providing hyper-personalization at scale. The ultimate phase is human-led, agent-operated insurance operations, where your human workforce sets strategy and exceptions, and a fleet of AI agents handles day-to-day processes.

In 2026, AI is transforming traditional business models by enabling them to serve as digital coworkers rather than passive tools.

Why Insurers Can't Scale AI Without an AI-Native Core

Here’s the hard truth: you can’t build a skyscraper on a foundation of sand. Similarly, you can’t build an AI-driven enterprise on a foundation of legacy technology.

Trying to run agentic AI on a 20-year-old legacy system is like trying to run a modern high-speed train on 19th-century railroad tracks; the infrastructure simply won’t support the speed. An AI-native core refers to core insurance systems (policy administration, claims, billing) built with modern technologies—cloud, microservices, and real-time data architecture—and AI capabilities embedded by design. Modern AI technologies are now integral to these systems, enabling digital transformation, operational efficiency, and strategic innovation from the ground up. These systems are open and agile, making it easy to plug in AI models, feed them data, and integrate their outputs back into workflows.

"The industry is at a pivotal crossroads. For years, we've treated AI as a feature—an add-on to legacy software. That era is over. The future of insurance isn't about bolting AI onto old infrastructure; it's about building on an AI-native foundation where intelligent agents are the core. The change will be seismic, not evolutionary. Those who act now will adapt. Those who wait will experience it as a revolution." Manish Shah, Chief Product Officer, Majesco

Bain’s research noted that the real breakthrough for the 4% of insurers scaling AI was that they redesigned processes around AI instead of trying to bolt AI onto legacy manual steps [2]. Leaders set a clear ambition to rethink processes end-to-end—often by replacing legacy systems—rather than layering AI on top of old workflows.

Leading companies are now centralizing "AI Studios" to focus on high-ROI workflows, moving beyond experimental projects to achieve measurable business impact.

Agentic AI Systems vs. RPA vs. Workflow Automation

Understanding the difference between these technologies is crucial for any leader serious about building a future-proof insurance operation.

Robotic Process Automation (RPA) mimics human keystrokes to automate repetitive, rule-based tasks. Think of it as a player piano—great for simple, stable processes, but incredibly brittle. If a button on the screen moves, the RPA bot breaks. It can’t read unstructured data or make a judgment call.

Workflow automation follows a pre-defined, linear sequence of steps—like a factory assembly line. It’s more robust than RPA, but still rigid. If an unexpected situation arises, the process halts until a human intervenes.

Agentic AI is a different species altogether. An AI agent is not just following a script; it’s pursuing a goal. You don’t tell it how to do something; you tell it what you want to achieve. The agent then determines the steps: it accesses the core system, retrieves the necessary data, runs it through a risk model, and communicates with other systems to obtain the information it needs. This ability to reason, adapt, and learn is what makes agentic AI so powerful.

By embedding unique expertise and proprietary methods into AI workflows, insurers can improve decision-making and operational excellence, ensuring that specialist knowledge is consistently applied at scale. AI also enhances fraud detection and prevention by analyzing patterns and anomalies in large datasets, providing a significant advantage over traditional automation approaches. It’s not just automating tasks; it’s automating outcomes.

Why "AI on Top of Legacy" Fails at Scale

The temptation to simply “add” AI to existing legacy systems is understandable. It seems faster, cheaper, and less disruptive. But this “AI on top of legacy” approach is a trap. It might deliver a few quick wins, but it will never scale to the enterprise level.

Data silos and inaccessibility are the first culprits. Legacy systems trap data in silos. An AI model is only as good as the data it’s trained on. Without real-time, integrated data, an AI agent is flying blind. Insurers who have tried this approach often find they spend 80% of their time and budget on data extraction and cleaning.

Lack of agility and integration is the second barrier. Legacy systems were not built for the age of AI. They are often monolithic, closed, and difficult to integrate with. This lack of agility prevents you from quickly experimenting with new AI models or adapting to changing business needs. Transforming operating models is crucial for scaling AI initiatives, enabling organizations to rewire workflows, improve efficiency, and gain a competitive advantage.

Poor governance and trust are the third challenge. When AI is bolted onto legacy systems as an afterthought, it’s difficult to govern and trust. It’s hard to track how the AI is making decisions, and even harder to ensure those decisions are fair, transparent, and compliant. This “black box” problem is a major concern for regulators.

Investing in broad AI literacy enables staff to oversee agents rather than performing specialized tasks, ensuring organizations can fully leverage the benefits of agentic AI.

Home Insurance and Tailored Solutions

The integration of agentic AI systems is ushering in a new era for home insurance, where tailored solutions are not just possible—they’re becoming the industry standard. By leveraging the power of AI agents, insurers can now access and analyze a vast array of data sources, from historical claims data to real-time property information, to deliver more accurate risk assessment and truly personalized policies.

For example, agentic AI can sift through years of claims data and external risk factors, such as weather patterns, local crime rates, and even building materials, to identify trends and anticipate potential losses. This deep analysis enables insurers to offer competitive pricing that reflects each customer's true risk profile, making home insurance more cost-effective for both insurers and policyholders.

But the benefits don’t stop at underwriting. In claims processing, agentic AI systems can rapidly assess damage, validate claims against historical data, and even initiate payouts with minimal human intervention. This not only reduces operational costs but also dramatically improves the customer experience, providing faster resolutions and greater transparency.

Ultimately, agentic AI empowers insurers to move beyond one-size-fits-all products. By understanding each customer’s unique needs and risk factors, insurers can deliver tailored solutions that drive loyalty and attract new customers—setting a new benchmark for service in the insurance industry.

Change Management and Implementation

Successfully adopting agentic AI systems requires more than just new technology. It demands a strategic approach to change management across the entire organization. Insurance companies must begin by evaluating their current business functions, technical capability, and data governance frameworks to ensure they are ready to support the integration of agentic AI.

A robust change management plan is essential to minimize disruption and ensure compliance with regulatory standards. This means not only updating processes and technology, but also preparing employees to work alongside AI agents. Training and support are critical, as staff will need to adapt to new workflows and develop the skills to oversee and collaborate with AI-powered systems.

Equally important is the impact on customers. Insurers should clearly communicate the benefits of the new technology and provide guidance and support to help customers navigate any changes in service delivery. By adopting a phased implementation approach, starting with pilot programs in select business areas and scaling up as capabilities mature, insurers can manage risk, gather feedback, and refine their strategy for broader rollout.

Ultimately, effective change management ensures that agentic AI systems are integrated smoothly, enabling the organization to operate efficiently, maintain regulatory compliance, and deliver greater value to employees and customers.

Measuring Success and Impact

To realize the full potential of agentic AI systems, insurance companies must establish clear metrics to measure success and drive continuous improvement. Key performance indicators should include reductions in operational costs, faster, more accurate claims processing, and measurable improvements in customer experience.

Tracking the acquisition of new customers and the retention of existing customers provides insight into the market impact of AI-driven offerings. Revenue growth, improved risk assessment, and the ability to offer competitive pricing are further signs of a successful AI transformation.

Regular data-driven assessments enable insurers to identify areas for optimization and ensure that agentic AI systems deliver on their promise. Leveraging predictive analytics, companies can forecast trends, anticipate customer needs, and stay ahead of the competition in a rapidly evolving market.

By embracing the AI revolution and investing in agentic AI, insurers not only gain a competitive edge but also position themselves as leaders in delivering innovative, customer-centric solutions that define the future of the insurance industry.

The Role of Human-in-the-Loop Governance in Regulated Industries

The rise of agentic AI does not mean the end of human involvement. In a highly regulated industry like insurance, the opposite is true. The most successful agentic frontier firms are building sophisticated human-in-the-loop (HITL) governance models that combine the speed and scale of AI with the judgment and oversight of human experts. AI systems, including agentic and multiagent systems, support and enhance the roles of human agents in insurance operations by providing real-time assistance, automating routine tasks, and enabling them to focus on more complex, value-added activities, ultimately improving customer service and operational efficiency.

In a HITL model, AI agents handle routine tasks and decisions, but they are programmed to escalate exceptions, anomalies, and high-stakes decisions to human supervisors. The human is no longer in the weeds of every transaction; instead, they act as a strategic orchestrator, a quality controller, and a final arbiter.

First, you define the guardrails, setting clear thresholds for when an agent should escalate a decision. An AI claims agent might be authorized to automatically approve any property claim under $5,000, but any claim above that amount, or any claim with a hint of fraud, is immediately flagged for human review.

Second, you create feedback loops. When an AI agent escalates a decision, the human’s response is a learning opportunity for the AI. This continuous feedback loop allows the AI to get smarter over time.

Third, you ensure auditability and transparency. In a regulated industry, you have to explain how and why a decision was made. An AI-native core with a strong HITL framework provides a complete audit trail for every AI-driven decision.

The role of the human in an agentic frontier firm is to be a teacher, a mentor, and a governor of AI—to focus on the complex, the ambiguous, and the strategic.

Adopting ambient interfaces allows leaders to access AI intelligence during high-stakes interactions without losing focus.

The Future Belongs to Those Who Act

We’re entering an era where the competitive advantage in insurance will be defined not by the size of your balance sheet, but by the intelligence of your operations. The agentic frontier firm is being built today by insurers who have the courage to reimagine their business from the ground up.

Adopting advanced AI technologies is essential for future readiness, as these tools enable innovation, drive operational efficiency, and are integral to digital transformation in insurance and financial services. The opportunity—and challenge—is that this transformation requires more than technology. It requires a fundamental shift in mindset, from a traditional, process-oriented view to a more agile, data-driven, and experimental one. It requires a willingness to invest in modernizing core systems and reskilling the workforce. It requires a commitment to responsible, human-centric AI that builds trust among customers, regulators, and society.

"The transition to an agentic model is not just about technology; it's a strategic imperative that will redefine the competitive landscape. By 2030, we predict a 20-point expense ratio difference between AI-leaders and laggards. This isn't just about automation; it's about creating a more resilient, human-centric, and intelligent insurance ecosystem. The winners will be those who not only adopt AI but also master the art of human-agent collaboration, turning operational efficiency into a powerful engine for growth and customer value." Denise Garth, Chief Marketing Officer, Majesco

The real question is, can insurance change, and furthermore, who will lead that change. Will you observe from the stands, or lead from the field? The next two to three years will separate the frontier firms from the followers. The time to act is now. AI can provide insurers with a competitive advantage by enabling faster, more accurate services and better pricing.

Frequently Asked Questions (FAQs)

Q1: What is an Agentic Frontier Firm in insurance?

An Agentic Frontier Firm is an insurance company that integrates autonomous AI agents deeply into its core operations. These firms leverage agentic AI systems to automate and optimize processes like underwriting, claims processing, and customer service, while maintaining human oversight for strategic decisions and regulatory compliance. Leadership roles, such as the vice president of innovation or technology, are critical in driving AI integration and strategic experimentation within these organizations.

Q2: How does Agentic AI differ from traditional AI or robotic process automation (RPA)?

Unlike traditional AI or RPA, which typically follow predefined rules or respond to specific prompts, Agentic AI systems can plan, decide, and act autonomously to achieve goals with minimal human intervention. They adapt to dynamic environments and orchestrate complex workflows, making them far more flexible and powerful.

Q3: Why is an AI-native core system important for scaling agentic AI in insurance?

An AI-native core system is built on modern technologies that support real-time data integration, cloud infrastructure, and embedded AI capabilities. This foundation enables seamless deployment of agentic AI, agile adaptation to changing business needs, and robust governance—something legacy systems often cannot provide.

Q4: What role does human-in-the-loop governance play in Agentic AI operations?

Human-in-the-loop governance ensures that while AI agents handle routine tasks autonomously, humans oversee exceptions, high-stakes decisions, and compliance. This model balances speed and scale with accountability, transparency, and regulatory compliance essential in the insurance industry.

Q5: What are some benefits insurers gain by adopting Agentic AI?

Insurers can achieve faster claims processing, more accurate risk assessment and underwriting, improved fraud detection, personalized customer engagement, and significant reductions in operational costs. Agentic AI streamlines the claims process by automating tasks such as document verification, damage assessment, and claim approval, including the extraction and analysis of information from complex documents, such as medical records. Early adopters also gain a competitive edge by enhancing efficiency and customer experience.

Q6: What challenges do insurers face when implementing Agentic AI?

Key challenges include data silos, legacy system limitations, governance and trust issues, workforce reskilling, and cultural resistance. Overcoming these requires a comprehensive AI transformation strategy, investment in modern infrastructure, and effective change management.

Q7: How can insurers begin their journey toward becoming an Agentic Frontier Firm?

Start by assessing current processes and technology, invest in AI-native core platforms, embrace a culture of experimentation and continuous improvement, implement robust data governance, and develop human-agent teams combining AI autonomy with human oversight.

Q8: How does Agentic AI impact customer experience in insurance?

Agentic AI enables 24/7 personalized support, rapid claims acknowledgment, tailored policy recommendations, and proactive communication. Customers also benefit from the convenience of setting up, managing, and modifying their policies online, which streamlines service and increases satisfaction. This leads to higher customer satisfaction, faster service, and stronger loyalty.

Q9: Can Agentic AI ensure regulatory compliance in insurance operations?

Yes, Agentic AI systems can be designed with built-in compliance guardrails, audit trails, and escalation protocols to ensure all decisions meet regulatory standards. Human oversight further reinforces compliance with requirements.

Q10: What is the future outlook for Agentic AI in the insurance industry?

Agentic AI is set to redefine insurance operations by enabling fully autonomous workflows and AI-native business models. For example, agentic AI can autonomously deploy drones or ground robots to inspect properties for underwriting or post-claim evaluation, and can continuously adjust premiums in near-real-time based on new data sources, such as IoT device inputs or climatic changes. Insurers who act now to integrate these technologies will lead the industry in efficiency, innovation, and customer-centricity in the new era of AI-driven insurance.

Q11: How does Agentic AI improve fraud detection and prevention?

Agentic AI enhances fraud detection and prevention by analyzing patterns and anomalies in large datasets to identify potential fraud more quickly, allowing insurers to respond proactively and reduce losses.

References

[1] Munich Re. aiSure™ – AI-based quality guarantee for AI models.

[2] Bain & Company. The 4% of P&C Insurers That Are Scaling GenAI.

[3] OECD. The Future of Productivity. The Frontier Firms Technology Diffusion and Public Policy

[4] Microsoft. Work Trend Index 2025

[5] Harvard Business Review. Build a AI Strategy. Adopting an AI First Strategy

[6] Deloitte. The State of Generative AI in the Enterprise

[7] Majesco. Majesco Copilot Results.

[8] Andreessen Horowitz. Navigating the Future of AI Agents. The Use of Computer Use of Agentic Coworkers

[9] Celent. Shedding Light on Agentic AI in Insurance